- USDCAD managed to maintain modest intraday gains around 1.2700.

- With the US dollar weakening and crude oil prices rising, the USD/CAD gains look limited.

- The Fed’s dovish outlook will limit the US dollar’s decline and urge traders to be cautious.

The USD/CAD forecast remains bearish as the US dollar weakened after Fed’s rate hike. Meanwhile, WTI prices are on the rise. At the start of the European session, the USD/CAD price pared modest intraday gains, retreating near a two-week low near 1.2675.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Risk-on sentiment

It gained some momentum during Thursday’s first half, although the rally lacked bullish confidence, and the pair dried up around the round number of 1.2700. As a result of this combination of factors, the Canadian dollar strengthened, and the USD/CAD pair lost momentum. Meanwhile, the prevailing risk sentiment continued to pressure the safe-haven US dollar, resulting in fresh selling.

Bullish WTI

After the International Energy Agency (IEA) said that markets could lose three million barrels a day of Russian oil and petroleum products, crude oil prices rose from April. The Canadian commodity-bound economy has benefited from this and a stronger than expected CPI. As a result, the Bank of Canada was under increasing pressure to increase interest rates as annual inflation in Canada hit its highest level since August 1991 in February.

However, the resurgence of COVID-19 cases in China has raised concerns about declining fuel demand. In addition, the prospect of a diplomatic solution to the war in Ukraine could deter significant gains for black liquid. Additionally, the Fed’s dovish outlook should limit the dollar’s decline. As a result, the USD/CAD pair should strengthen, which requires caution before aggressive bearish bets are taken.

Fed’s rate hike

For the first time since 2018, the Fed raised interest rates on Wednesday, and it also indicated that more aggressive measures should be taken to combat high inflation. Moreover, the Fed is expected to hike rates at all six of its remaining meetings in 2022, based on the so-called dot plot. Therefore, one would be wise to wait for subsequent selling before attempting to continue the bearish trend that started two days ago.

What’s next for the USD/CAD forecast?

The market now awaits the release of the US economic report, which includes the Philadelphia Fed Manufacturing Index, weekly initial jobless claims data, and industrial production data. The US dollar is also being affected by recent developments concerning the Russian-Ukrainian saga and a broader attitude towards market risk. The USD/CAD pair may continue to offer some opportunities if oil prices rise.

USD/CAD price technical forecast: Bulls find no respite

The USD/CAD price consolidates losses around the intraday lows of 1.2670. The 4-hour chat shows a bearish scenario as the key SMAs are pointing south. Any subsequent losses will result in a deeper retracement towards 1.2600 ahead of 1.2550. On the upside, any recovery attempt will remain capped by 1.2700 to 1.2730 area.

The volume also shows a bearish bias as the widespread down bar came up with ultra-high volume. The average daily range is very narrow, around 28% so far. It shows low volatility for the pair today.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

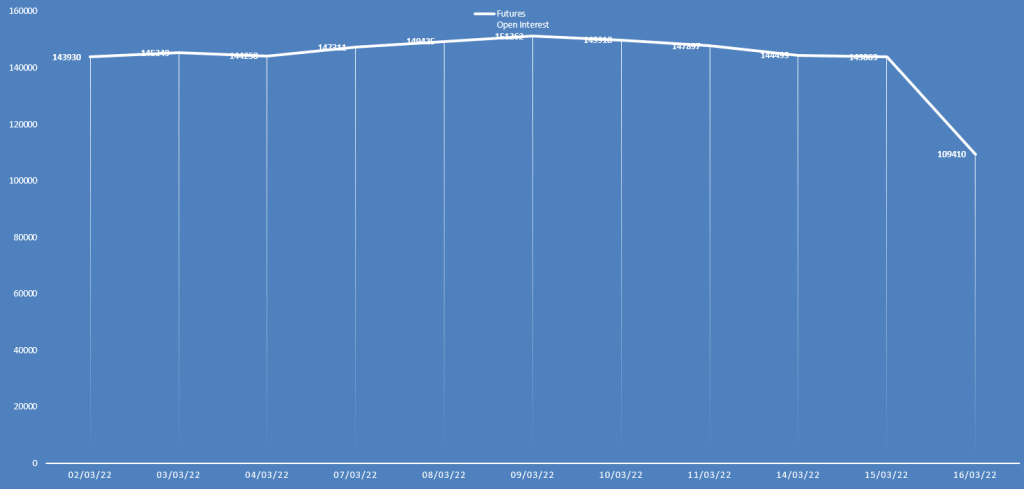

USD/CAD forecast via daily open interest

The USD/CAD price closed down yesterday while the open interest slumped down too. It means the profit-taking pushed the prices lower and the probability of upside still remains.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money