- Amidst market turmoil, the USD/CAD is struggling near intraday lows.

- WTI Oil falls to a week low on supply concerns and less activity in Russia.

- Macklem cited evidence that global supply chains and inflation were eased.

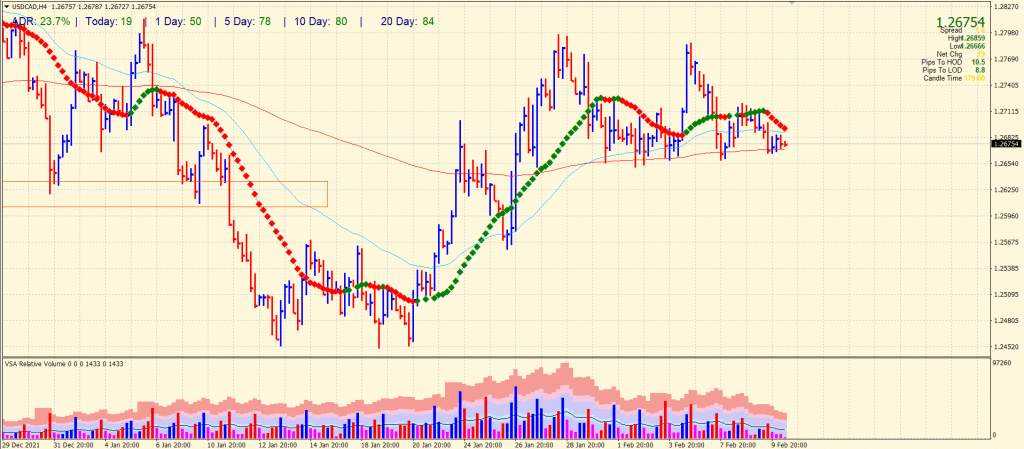

The USD/CAD forecast is bearish as the price turns negative below certain levels despite softer oil prices. Following the market’s movement ahead of Thursday’s European session, the USD/CAD pair remains under pressure at around 1.2675.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Low oil prices and recent mixed comments from Bank of Canada (BOC) Governor Tiff Macklem have limited USD/CAD’s movement lately, adding to worries ahead of US Consumer Price Index (CPI) data for January.

However, the Fed’s concerns about inflation are pushing it to raise rates faster. According to the White House (WH), the inflation rate will increase yearly, adding that “its outdated monthly numbers will continue to fall throughout the year.” However, WH economic adviser Brian Deese said he believed the factors driving inflation would gradually diminish in the future.

On the other hand, Cleveland Fed President Loretta Mester supported the rate hike in March, and Atlanta Federal Reserve President Rafael Bostic expressed hope for a gradual slowing of inflation on CNBC on Wednesday. According to Bostick, the Fed is leaning toward another hike in 2022.

BOC’s Macklem said, “Global supply chain problems may have peaked.” The policymaker blames higher inflation for the supply chain issues and says Canadians should expect rising interest rates.

After recovering from a one-week low, WTI crude oil prices fell 0.65% to as low as $88.50.

Due to this backdrop, US Treasury yields remain on the sidelines after falling from their highest levels since July 2019, and US and European equity futures are dropping.

In light of the market’s risk aversion and cautious sentiment ahead of major US data, USD/CAD traders may see further declines ahead of January’s US CPI release, which is expected to come in at 7.3% versus 7.0% y/y. However, it’s important to note that the bearish numbers could allow the Canadian pair to erase recent losses.

USD/CAD price technical forecast: Bears gathering strength

The USD/CAD price remains depressed below the key level of 1.2700. Moreover, the 20-period SMA on the 4-hour chart is above the price. The 200-period SMA provides weak support. Breaking the support may trigger more selling towards the 1.2600 area. The volume data is bearish bias as well.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

Conversely, if the pair jumps above 1.2700, we may see a bullish continuation towards 1.2750 ahead of the 1.2800 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money