- BoC hiked rates by 50bps, smaller than the 75bps forecasted.

- The BoC said it would continue hiking rates to bring inflation back to its target.

- Canada’s central bank cut its 2023 growth projections.

Today’s USD/CAD forecast is bearish as dollar weakness continues. However, the Canadian dollar weakened on Wednesday when the Bank of Canada announced a smaller-than-anticipated increase in interest rates.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

It stated that it was nearing the conclusion of its historic tightening campaign since it expected the economy to stagnate over the following three quarters.

The central bank raised its policy rate by half a percentage point, to 3.75%, surprising investors who had expected a 75bps hike. Since March, it has increased rates by 350 basis points, one of its quickest tightening cycles ever.

“How much higher rates need to go will depend on how monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding,” Governor Tiff Macklem told reporters.

The central bank, according to Macklem, was attempting to balance the dangers of under and overtightening but was still far from reaching its aim of low, steady, and predictable inflation at 2%.

The bank cut its growth projections for 2023 and predicted that economic activity would be nearly flat from the fourth quarter of 2022 through the first half of 2023.

Analysts noted that while hints of upcoming hikes take the edge off the surprise, the Bank of Canada may be growing more cautious. They speculated that the choice to test market pricing with a lesser move was likely influenced by the gloomier economic outlook.

USD/CAD key events today

Investors will pay attention to news releases from the US, including the core durable goods orders, the Gross Domestic Product (GDP) for Q3, and the initial jobless claims report.

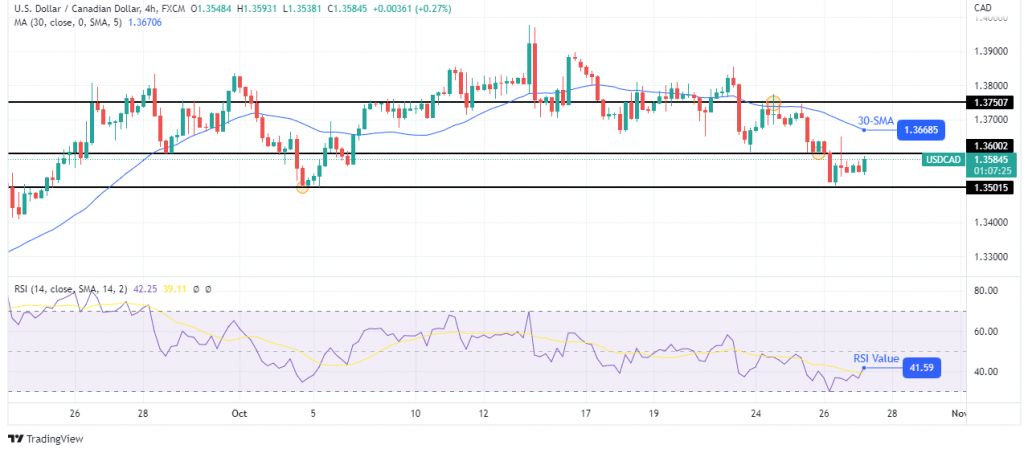

USD/CAD technical forecast: Bears eyeing the 1.3501 support level

Looking at the 4-hour chart, we see the price trading well below the 30-SMA and the RSI below 50, showing a strong downtrend. The price retested and found resistance at the 1.3750 key level, making a lower high.

–Are you interested to learn more about making money in forex? Check our detailed guide-

The downtrend was further confirmed when the price went on to make a lower low below the 1.3600 level. The price is now retesting this level, and bears look strong enough to lower the price. They will be looking to take out the next support level at 1.3501.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.