- USD/CAD looks positive above the key technical levels.

- The Bank of Canada remains in the spotlight.

- The covid situation in Canada is worse, leading to building some pressure around the Canadian dollar.

The USD/CAD price forecast is slightly bullish as the technical levels continue to lend support while the Bank of Canada is likely to suffer amid Omicron. Meanwhile, the US dollar bids may also return to the market.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

At the beginning of the week, the USD/CAD pair is under pressure, and a rise is technically possible once the price imbalance is fully corrected. Currently, the USD/CAD price is down around 0.13% at 1.2535 after falling from a high of 1.2557.

Last week, the Canadian fell below 1.2620 to trade at 1.2453 lows after breaking several daily structures. Since then, the price has corrected bearish momentum as the US dollar flees and the Fed bids.

One of the biggest problems for CAD is the Covid situation in Canada, which is quite severe. As a result, board members of the Bank of Canada will inevitably suffer from the restrictive measures taken to contain the spread of the new Omricon variant.

However, overall market expectations remain unchanged for the Bank of Canada. Despite the new wave of the virus, the economy has been strong, and there is optimism it will not be as deadly as previous outbreaks.

The December CPI data will be crucial for the Bank of Canada’s January 26th. While oil prices remain elevated, they will likely show a slight increase in headline inflation, stimulating further demand for the currency.

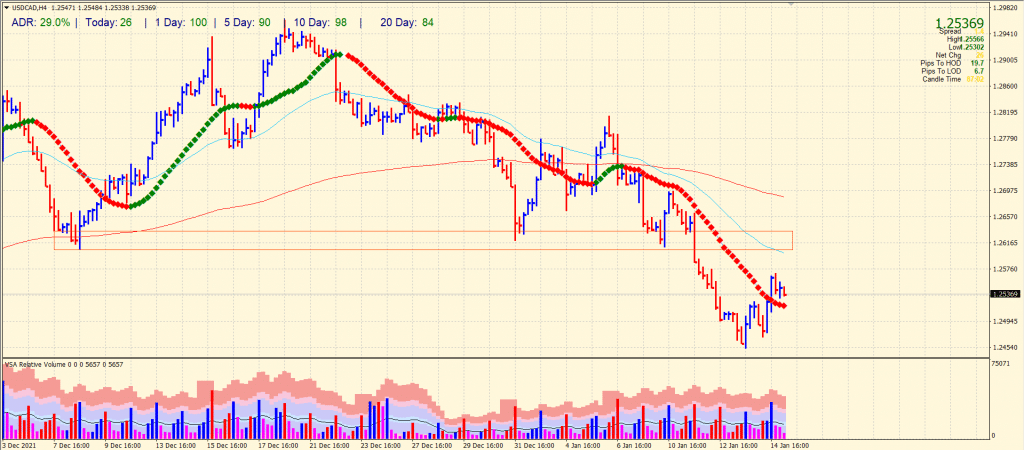

USD/CAD price technical forecast: 20-SMA to protect the downside

The USD/CAD price has jumped above the 20-period SMA on the 4-hour chart. Although the pair is currently declining, the technical outlook is still positive for the pair. On Friday, the consolidation around the 1.2450 area was broken as the pair moved beyond the 1.2500 handle. The volume data shows a rise with the up wave and a decline for the recent down wave. It offers the market’s willingness to push higher. Moreover, the downside is limited by the 20-period SMA ahead of 1.2450 swing lows.

–Are you interested to learn more about forex brokers? Check our detailed guide-

The average daily range for the pair lies at 29% during the Asian session which is quite normal. However, the bulls may face hurdle around the broken demand zone and the 50-period SMA near 1.2600-25.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.