- Canada’s inflation rose to 8.1% in June.

- Investors had expected inflation to come in at 8.4%.

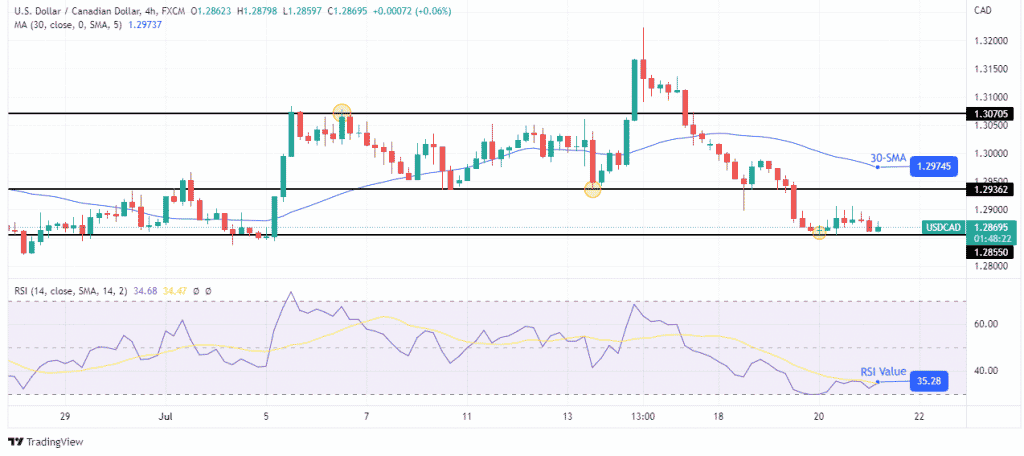

- In the charts, the price is experiencing support at 1.28550.

Today’s USD/CAD forecast is bearish as investors react to the high inflation report from Canada. The report showed a rise in inflation from May’s 7.7% to 8.1% in June. According to Statistics Canada, this rise came lower than the forecast of 8.4%.

–Are you interested to learn more about forex signals? Check our detailed guide-

“For one of the rare times in the last two years, we’ve actually got a number below expectations,” said Doug Porter, chief economist at BMO Capital Markets. “The bad news is we still have the highest inflation in roughly forty years.”

There was a rise in all three of the core measures of inflation, closely watched by the Bank of Canada. After raising rates by 100bps at its last meeting, the BOC said it expected inflation to stay around 8% in the coming months.

“It’s no time for complacency from the Bank of Canada, and we expect them to maintain a relatively forceful policy stance in September,” said Andrew Kelvin, chief Canada strategist at TD Securities. “The debate for September should be between 50 and 75-basis-point move.”

However, this inflation might cool off in July since oil prices have been falling.

USD/CAD key events today

USD/CAD investors will be paying attention to the initial jobless claims report from the United States. This report gives insight into the state of unemployment as it shows the number of new unemployment insurance applications in the past week.

From Canada, investors expect the new housing pricing index to drop from 0.5% to 0.3%. This index measures the change in the selling price of new homes in Canada. It will give a clear picture of how the housing sector is faring.

USD/CAD technical forecast: Volatility diminishing around 1.2855

The 4-hour chart shows consolidation at 1.28550, a solid support level. The price is trading far below the 30-SMA showing bears are strong. The downtrend also gets support from the RSI, trading below 50, showing strong bearish momentum.

–Are you interested to learn more about automated trading? Check our detailed guide-

At this point, the price might break below or bounce and retrace the recent leg down. A bullish move will likely find resistance at 1.29362, which acted as support on July 13. If the price goes beyond this level, the next resistance will come from the 30-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money