Dollar/CAD reached new highs as oil prices remained pressured and as the US Dollar gained across the board. What’s next? The BOC decision and the jobs report both promise a strong start to the last month of the year. Here are the highlights and an updated technical analysis for USD/CAD.

Oil prices stabilized but are very far from a full recovery. Trump took a tougher stance on trade and that pushed the US Dollar higher across the board. The Fed’s ongoing desire to raise rates also boosts the greenback.

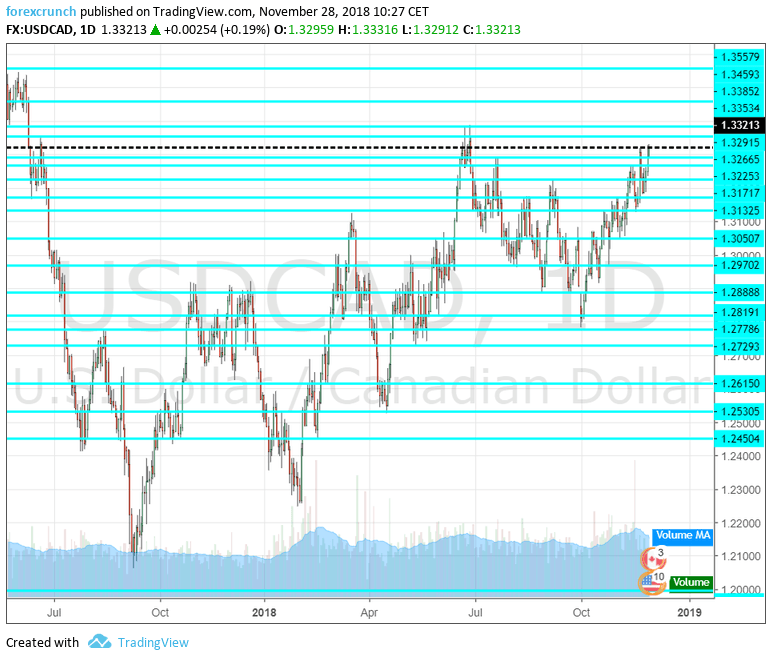

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 14:30. Markit’s purchasing managers’ index for the manufacturing sector stood at 53.9 points in October, indicating moderate growth. A similar figure is likely now.

- Labor Productivity: Tuesday, 13:30. Higher productivity is essential for quicker growth. Productivity increased by 0.7% in Q2 and we may see a more moderate figure this time.

- Canadian rate decision: Wednesday, 15:00. The Bank of Canada raised rates to 1.75% in October and also delivered a hawkish message. The upbeat assessment of the BOC is not fully reflected in the price due to the crash of oil prices. Governor Stephen Poloz and his colleagues are set to leave rates unchanged at this event, which does not consist of new forecasts nor a press conference. However, the Ottawa-based institution will likely maintain the hawkish bias and leave the door wide open to an increase in the Overnight Rate in January. Growth, employment, and the signing of the USMCA accord that replaces NAFTA, all support the BOC’s hawkish view.

- Housing Starts: Thursday, 13:15. The housing sector suffered from various jitters after sharp price rises in previous years. The annualized level of housing starts surprised with a recovery in October, hitting 206K.

- Trade Balance: Thursday, 13:30. Canada has a trade balance deficit for many months. However, it narrowed in September to only 400 million. Will we see a surplus this time?

- Ivey PMI: Thursday, 15:00. After a sharp drop in September due to concerns about the trade deal, October saw a substantial bounce back to the previous levels that show a robust rate of growth. For November, we may see a slide from 61.8 seen in October.

- Jobs report: Friday, 13:30. Canada’s job market is doing OK. Back in October, the unemployment rate fell to 5.8% and 11.2K positions were gained. The months before October saw high volatility. Apart from the headline numbers, it is important to note the composition of job changes: full-time and part-time, as well as the change in wages which has a growing impact on the loonie.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD extended its gains, eyeing the 1.13350 level (mentioned last week.

Technical lines from top to bottom:

1.3580 capped the pair back in June 2017 and towers above. 1.3460 separated trading ranges beforehand.

1.3385 was the high point seen in May and towers above. 1.3350 was a stepping stone on the way and on the way down around the same time.

1.3320 was the high point in late November. 1.3295 capped the pair back in July.

Lower, 1.3265 was the high point in mid-November. 1.3225 played a role in capping USD/CAD back in September.

1.3175 was a swing low in late November and it is followed by 1.3125 which was also a low point, earlier in the month.

Below 1.3000 we find the late-October trough of 1.2970. 1.2880 was a double-bottom in September and in August.

I remain bullish on USD/CAD

The mix of a defiant Trump on trade and a hawkish Fed finds Canada with falling oil prices. While other currencies may suffer more than the loonie, the trend is clear..

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!