- The USDCAD bounces off a weekly low after breaking a 2-day downtrend.

- Low oil prices remain due to a lack of catalysts and cautious sentiment leading up to the OPEC+ meeting.

- Gravelle BOC building permits will be placed on a watch list before an important job report.

As of early European morning Wednesday, the USD/CAD forecast seems bearish as the pair is below 1.2700, a weekly low. As key dates/events approach, the Canadian pair is tracking sluggish oil prices and a market that hesitates to consolidate recent losses.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

After jumping to an eight-year high on Friday, WTI crude, Canada’s top export, fell 0.20% on the day to $87.50. Meanwhile, energy traders are dealing with mixed concerns over the Russia-Ukraine dispute, recent rumors about Chinese competition law, and OPEC+ caution.

A refusal by Fed policymakers to publicly endorse a rate hike in March and stronger data from the US and Canada are also weighing on USD/CAD traders.

On Tuesday, Canada’s November GDP increased to 0.6% y/y, beating the market consensus of 0.3%, while Markit’s January manufacturing PMI fell to 56.2 from 56.9 expected.

US ISM Services PMI rose to 57.6 in January from an expected 57.5, marking the 20th straight month of growth in manufacturing activity. In addition, On Tuesday, Rafael Bostic, Atlanta Fed president, said that inflation expectations will deviate from the Fed’s target of 2.0% to 4% or higher. Similarly, James Bullard, President of the St. Louis Fed, believes it remains an open question whether the Fed should become more hawkish (i.e., interest rates to rise above the “neutral” zone from 2.0% to 2.5%).

While these games are unfolding, US 10-year Treasury yields have moderated the previous day’s rebound from a weekly low of around 1.80%, while positive Wall Street benchmark data is helping S&P 500 futures, which are currently trading around 4555, remain stable.

Following the recent disappointment, statements from the Bank of Canada’s Deputy Governor Tony Gravelle and Governor Tiff Macklem will be crucial as markets adjust to higher BOC rates. In recent weeks, BOC’s Macklem has been opposing inflation.

In addition, Friday’s early reading for January’s Nonfarm Payrolls change from 207k versus 807k; today’s US ADP data will be critical to assessing short-term USD/CAD movements ahead of the next payroll data.

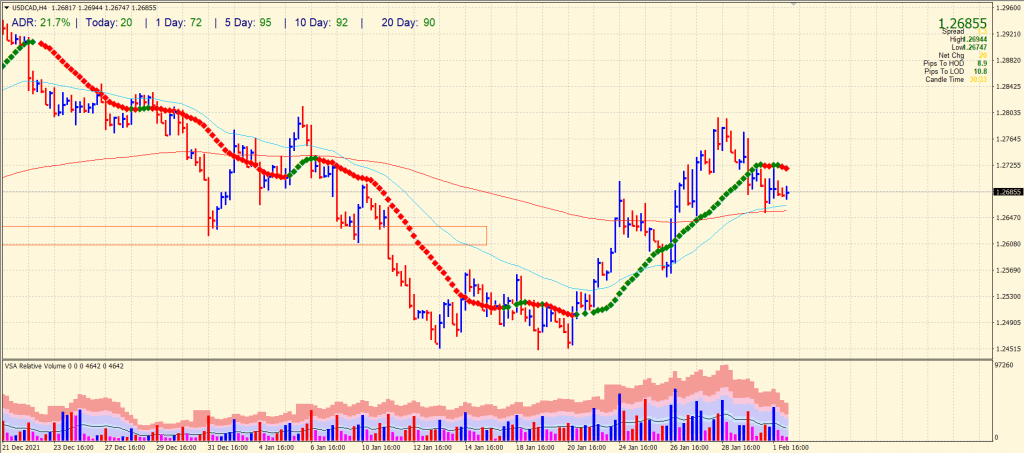

USD/CAD technical forecast: Key SMAs supporting

The USD/CAD price falls below the 20-period SMA. However, the conjunction of 50 and 200 SMAs provide support around 1.2650-60. Breaking the zone may attract sellers towards 1.2600 ahead of 1.2550.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

The volume data favors the downside as the upthrust bar with very high volume indicates a strong bearish bias. Alternatively, sustaining above 1.2700 may gradually shed off bears and move towards 1.2800.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.