- The USD/CAD caught aggressive offers on Thursday, supported by various factors.

- The dollar gained support as oil prices dropped, adding to renewed demand for the US currency.

- Market participants now focus on the OPEC+ meeting, US/Canadian macro data, and geopolitics for fresh impetus.

The USD/CAD forecast is slightly positive today as the crude oil is retreating, weighing on the Canadian dollar. Moreover, the greenback is showing some strength. The USD/CAD price hit a three-day high of 1.2535-1.2553 in the first half of the European session.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

On Thursday, the USD/CAD pair bounced back from the lowest levels since November 2021, which were set the previous day, thanks to supportive factors. First, crude oil prices dropped sharply in February, undermining the commodity-pegged Canadian dollar and boosting demand for the US dollar.

A report suggesting the US is considering releasing 180 million barrels from its Strategic Petroleum Reserve (SPR) sent crude oil prices plunging over the next few months. In addition, concerns that China’s COVID-19 restrictions could negatively affect the fuel have also weighed on the price of the black liquid.

The dollar reversed the previous day’s slide to a near two-week low, helped by expectations of aggressive Fed tightening combined with fading hopes of diplomacy in Ukraine. The Fed will raise rates by 50 basis points in the next two meetings to combat high inflation, according to the markets.

Although traders prefer to wait for key macroeconomic data from the US and Canada, the fundamental backdrop remains bullish for further intraday gains. Today’s economic update features the US core PCE price index and Canada’s monthly GDP report later in the North American session.

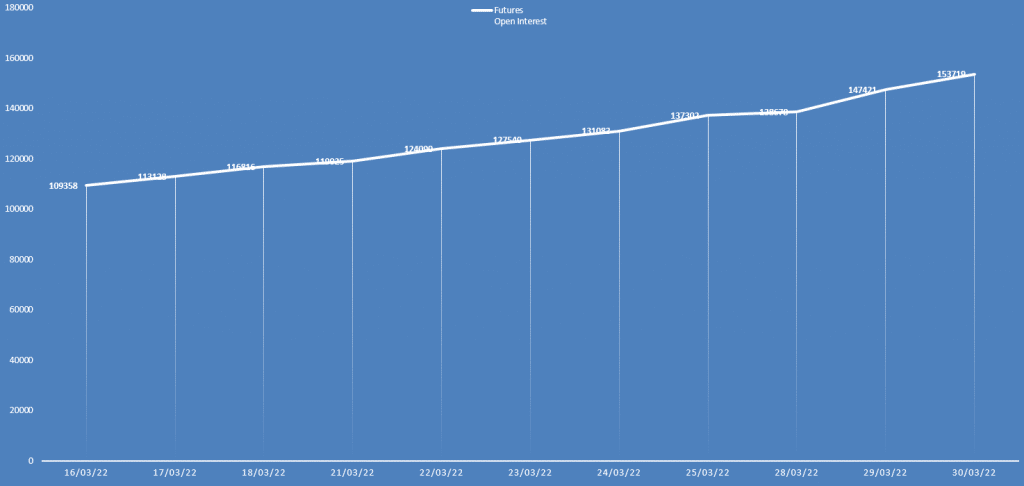

USD/CAD daily open interest forecast

The USD/CAD price closed in red yesterday while the open interest increased. It shows a bearish bias.

What’s next to watch for the USD/CAD?

Several factors will influence the dynamics of oil prices, including the OPEC+ meeting and the Russia-Ukraine saga. In addition, US bond yields and broader market risk sentiment will bolster demand for the US dollar and create short-term trading opportunities around the USD/CAD pair.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

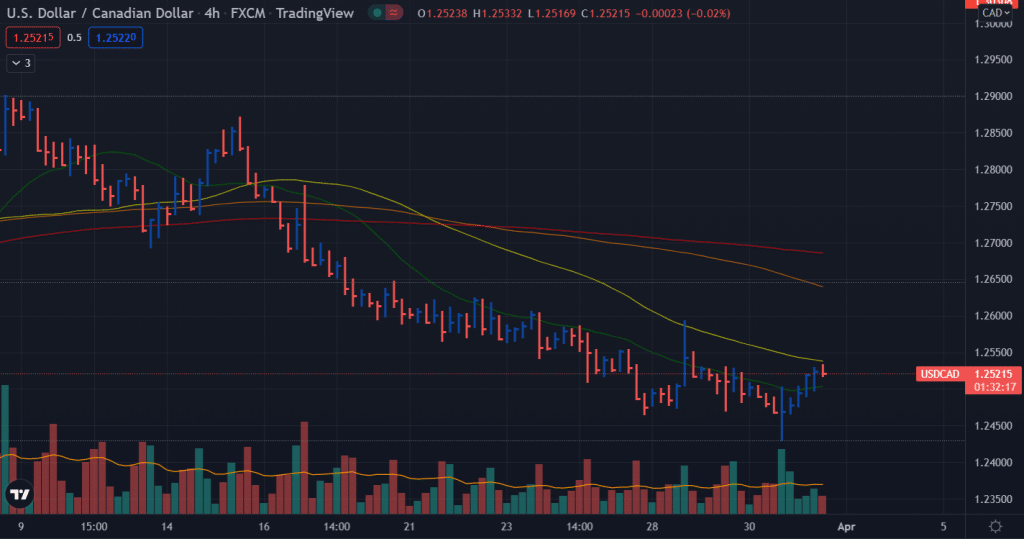

USD/CAD price technical forecast: Bulls lacking follow-through

The USD/CAD price jumped above the 20-period SMA on the 4-hour chart. However, the bulls may find some resilience around the 50-period SMA. The 100 and 200 SMAs are also pointing to the downside. The volume is below the average for the recent up bars. It shows a consolidating behavior. Hence, we expect the price to stay between 1.2450 to 1.2600.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money