In the US, consumer confidence soared, as the Consumer Board Consumer Confidence Index climbed to 121.7, up from 113.1 beforehand. The US dollar dipped after the FOMC meeting, as the Fed said it was premature to discuss tapering.

US GDP rose 6.4%, beating the forecast of 6.1%. The robust reading was another sign that the US economic recovery is in full swing.

- Manufacturing PMI: Monday, 13:30. Manufacturing continues to show strong growth. In February, the index rose to 58.5, up sharply from 54.8 beforehand. We now await the March data.

- Building Permits: Tuesday, 12:30. Building Permits rose 2.1% in February. The estimate for March stands at 0.4%.

- Employment Report: Friday, 12:30. The labor market has looked strong, as the economy created 303 thousand jobs in March. Will we see another sharp gain in April? The unemployment rate came in at 7.5% in March but is expected to rise to 8.0% in April. Wage growth posted a gain of 2.0% in March and we now await the April data.

- Ivey PMI: Friday, 14:00. The PMI jumped to 72.9 in March, up from 60.0 beforehand. The index is expected to soften to 60.5 points in April.

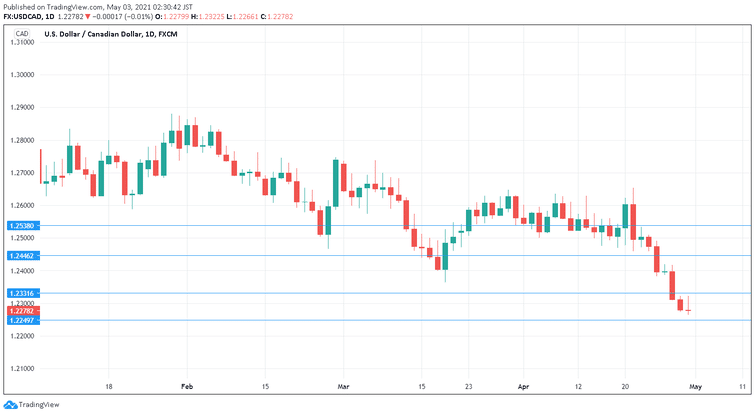

The US dollar continues to struggle, and risk sentiment is strong, buoyed by the strong US economy. This bodes well for minor currencies like the Canadian dollar.

Follow us on Sticher or iTunes

Further reading:

-

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe Trading!