- The USD/CAD pair is still clinging to its lows of the past two months.

- The US dollar has failed to support high Treasury yields for several months.

- Geopolitical concerns and a weaker dollar are causing oil prices to soar.

- Powell at the Fed, risk catalysts awaiting fresh impetus.

The USD/CAD price forecast remains strongly bearish as the crude oil rises, keeping the CAD underpinned while the USD struggles to hold. Before the European session begins on Wednesday, the USD/CAD is near a 2-month low and retreating towards 1.2575.

–Are you interested in learning more about STP brokers? Check our detailed guide-

WTI to weigh on USD/CAD

The loonie hit new multi-day lows after breaking key support the previous day. Lately, higher prices for Canada’s top export, WTI oil, have given the pair’s sellers hope.

The lack of positive statements in the peace talks between Ukraine and Russia and Russia’s war in Mariupol do not keep oil prices low. However, European sanctions previously prompted a decline in the price of black gold.

For now, WTI crude oil prices rose on the day by 1.30% to nearly $109.70, reversing yesterday’s decline from a two-week high.

Rising Treasury yields

The inability of the US dollar to support high US Treasury yields could also benefit USD/CAD sellers. In the meantime, fears over Fed Chair Jerome Powell’s speech sparked a bond collapse earlier this week that limited traders’ momentum.

With stock futures struggling to keep up with Wall Street’s rise at the time of writing, US 10-year Treasury yields in Asia rebounded to their highest since May 2019, at the latest 2.40%.

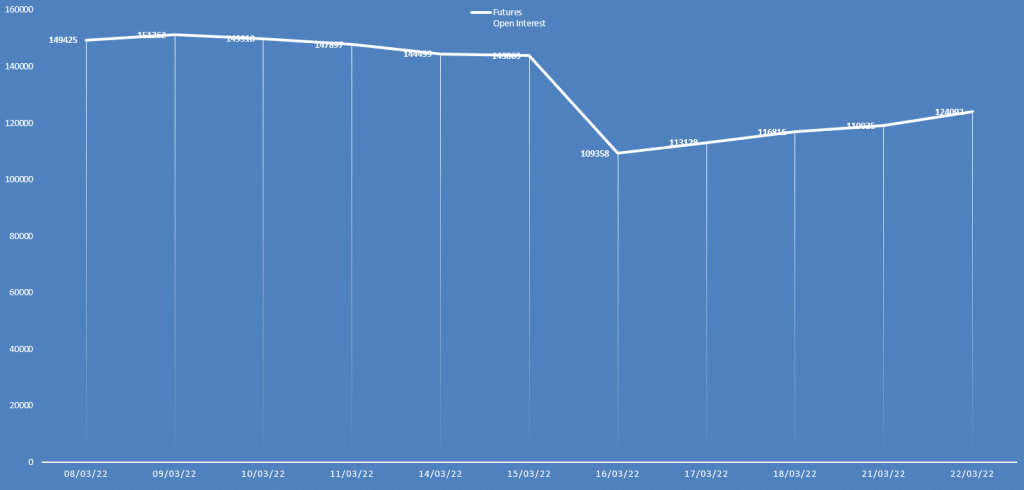

USD/CAD forecast via daily open interest

The USD/CAD price sharply dipped on Tuesday while the daily open interest for the pair also gained. It indicates a clear downside bias as the net sellers increased.

What’s next for the USD/CAD forecast?

In addition to Fed Powell’s speech, traders should also watch for risk catalysts.

USD/CAD technical forecast: Consolidating at the bottom

The USD/CAD price formed a double bottom at 1.2560 on the 4-hour chart. The pair seems bearish, but the breakout of consolidation on the upside is possible after forming a double bottom. However, if the double bottom breaks, we may see a downside towards 1.2500 ahead of 1.2450.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

The volume data shows no respite for the bulls at the moment. Therefore, it is prudent to wait for the consolidation breakout to find any trading opportunity.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money