- USD/CAD rallied after the ECB meeting on dollar strength.

- The Bank of Canada remains focused on taming inflation.

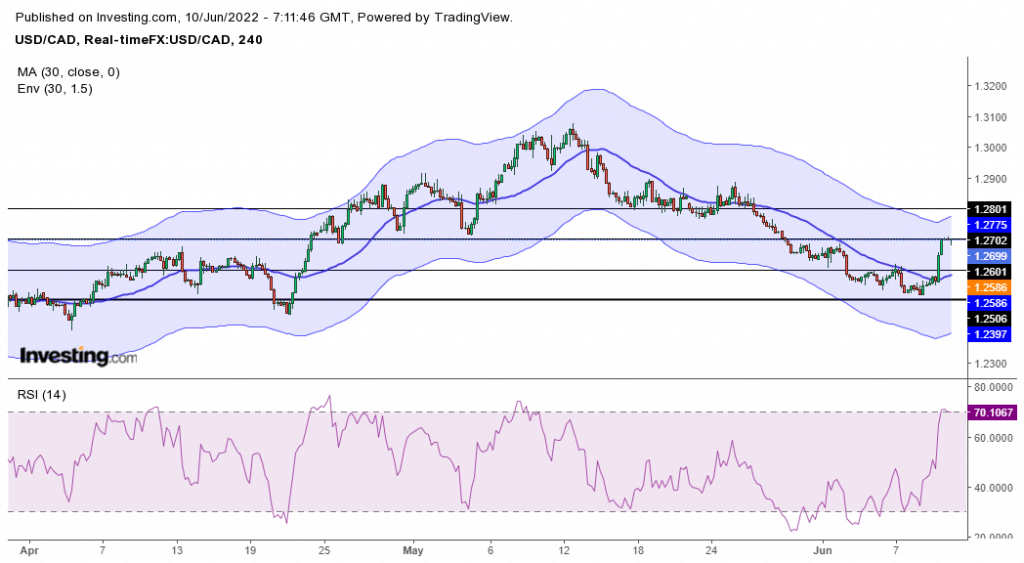

- The bulls are attempting a break of 1.2700 in the charts.

The USD/CAD price closed Thursday on an impressive bullish candle after the ECB meeting, rendering a strongly bullish forecast. The ECB held interest rates at 0.00%, as investors had expected, and this caused the dollar to rally after the meeting, pushing USD/CAD higher.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

Investors ignored hawkish remarks from officials at the Bank of Canada. In an interview with Reuters, senior Deputy Governor Carolyn Rogers said higher interest rates will weigh on housing and highly-indebted Canadians but are needed to curb inflation at a 31-year high of 6.8%.

Rogers made it clear the central bank is also paying attention to the small but growing number of Canadians who are heavily indebted after buying homes at elevated prices.

“We know very well that they’re the folks who will be most affected by interest rate increases. It’s something we’re going to watch closely,” Rogers said. “But all Canadians are affected by high inflation, and that’s our mandate.”

USD/CAD key events today

Investors will be looking out for news releases from the US and Canada later in the day. Canada will be releasing its jobs data with an employment change expected to go up from 15.3K to 30.0K. Investors expect the unemployment rate to hold at 5.2%.

From the US, there will be the consumer price index, which measures the change in the price of goods and services from the consumer’s perspective. This data is a good indicator of inflation in the country, and investors expect a drop from 0.6% to 0.5%.

USD/CAD technical forecast: Bulls sustaining above 1.2700

Looking at the 4-hour chart, we see that the price has made a steep bullish move to 1.2700 after breaking above the 30-SMA. This move is a clear indication of a sudden change in sentiment. At this point, the price is overbought as the RSI is in the overbought region. For this reason, there is the possibility of bears coming to push the price lower to retest the recently broken SMA.

-Are you interested in learning about the forex indicators? Click here for details-

A push lower is likely to find support at 1.2600 before resuming the bullish trend. The price is experiencing resistance at 1.2700, which might break above if bulls maintain their strength.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money