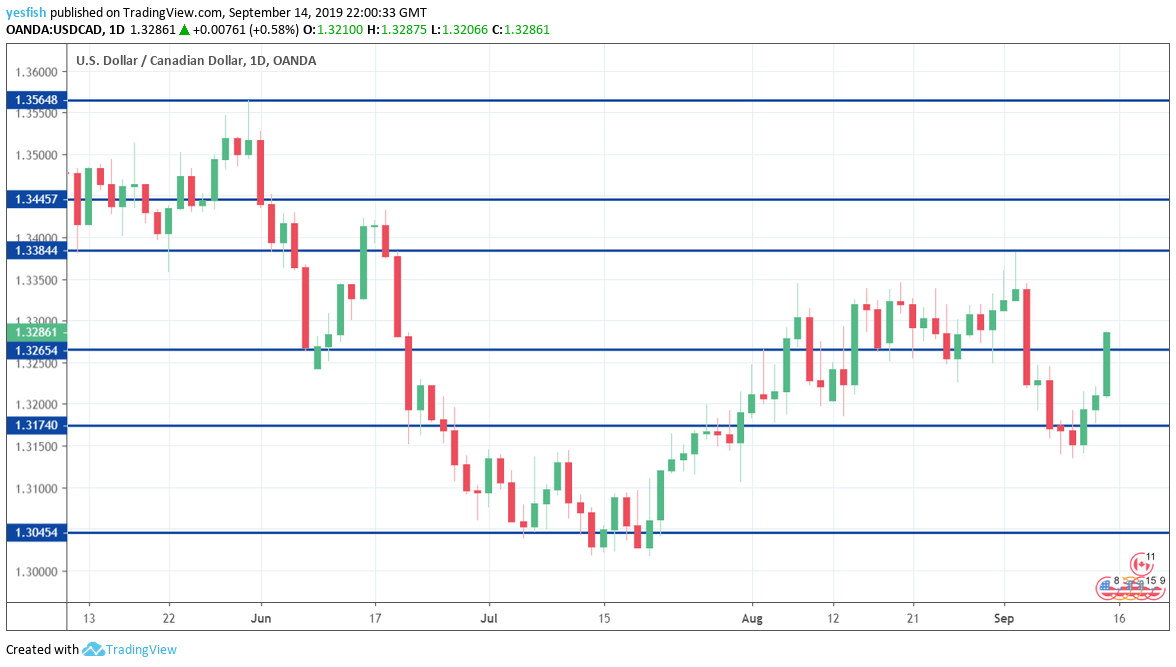

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Monday, 12:30. Demand for domestic securities has been swinging wildly, resulting in forecasts which have been off the mark. In July, demand slipped by C$3.9 billion, after a strong gain of C$10.20 billion a month earlier. We will now receive the August data.

- Manufacturing Sales: Tuesday, 12:30. Manufacturing sales has been struggling, with two declines in the past three months. In June, the indicator declined 1.2%, its sharpest decline in six months. The markets are braced for another decline, with an estimate of -0.3%.

- Inflation: Wednesday, 12:30. CPI was unexpectedly strong in July, with a gain of 0.5%. This easily beat the estimate of 0.1%. However the estimate for August stands at -0.3%.. Core CPI gained 0.3% in July, up from zero in the previous release. Will we see a stronger reading in August?

- ADP Nonfarm Employment Change: Thursday, 12:30. The ADP report sparkled in July with a gain of 73.7 thousand and the official NFP report followed suit with a sharp gain of 81.1 thousand. The August ADP reading is next.

- Retail Sales: Thursday, 12:30. Retail sales have been sluggish in recent months and dipped to zero in June. Still, this was above the estimate of -0.3%. Investors are expecting a rebound in July, with an estimate of 0.2%. Core retail sales jumped 0.9% in June, rebounding from -0.3% in May. A much smaller gain of 0.2% is the estimate of July.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3630. 1.3565 is next.

1.3445 has held in resistance since the first week of June. This is followed by 1.3385.

1.3350 is the next resistance line.

1.3265 is an immediate support line. It could see action early in the week. 1.3175 is next.

1.3125 (mentioned last week) has provided support since the end of July.

1.3048 is protecting the round number of 1.3000, which has psychological significance.

1.2916 has held firm since October.

1.2830 is the final support line for now.

I remain bullish on USD/CAD

Global economic conditions and the ongoing trade war between the U.S. and China and turmoil in the Middle East could weigh on risk currencies like the Canadian dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!