- The BOC is anticipated to keep its benchmark rate constant at a 15-year high of 4.50%.

- Core US inflation is anticipated to have increased by 5.6% annually in March.

- Investors are awaiting the March FOMC meeting minutes for clues on monetary policy direction.

Today’s USD/CAD forecast is bearish. Tuesday saw the Canadian dollar gaining ground versus the US dollar as oil prices increased.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

At its policy announcement on Wednesday, the Canadian central bank is anticipated to ignore the recent economic momentum and keep its benchmark rate constant at a 15-year high of 4.50%. Such a move would show the bank is hoping that activity will slow as higher borrowing rates become more prevalent.

The BOC paused rate hikes last month following eight consecutive rate increases.

The critical US inflation report will likely influence how quickly the Federal Reserve ends its aggressive rate hikes. Markets expect at least one more increase at the policy meeting next month.

Core inflation is anticipated to have increased by 0.4% on a monthly basis and 5.6% on an annual basis in March.

Later in the day, the Fed’s March meeting minutes will be made public. Investors will pore over them in search of hints about the Fed’s monetary policy and the effects of the stress in the banking industry.

On Tuesday, the International Monetary Fund downgraded its projections for global growth in 2023 and warned that hidden financial system vulnerabilities might explode into a new crisis and hamper this year’s global growth.

USD/CAD key events today

Investors will pay close attention to the Bank of Canada policy meeting, where the bank is expected to hold rates. They will also be keen on the US inflation report and the FOMC meeting minutes.

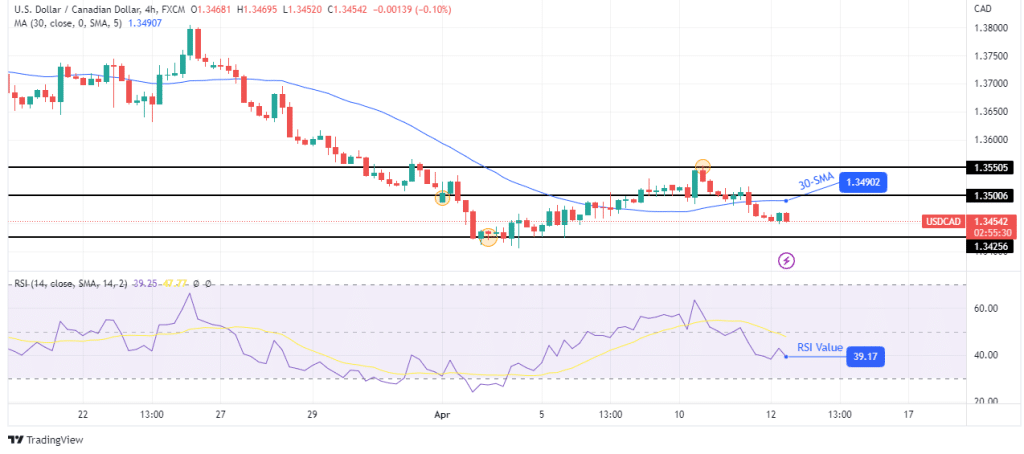

USD/CAD technical forecast: Bears aiming at 1.3425 support

The 4-hour chart shows USD/CAD in a bearish move that started at the 1.3550 resistance level. The price broke below the 1.3500 key psychological level and the 30-SMA support. The price is now trading below the 30-SMA, and the RSI has crossed below 50, a sign that bears are in control.

–Are you interested to learn more about Australian forex brokers? Check our detailed guide-

The next stop for bears will likely be at the 1.3425 support level. We might see a break below this level if they are strong enough to make a new low.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money