- The US dollar reached a five-week peak against major currencies.

- Data revealing increased inflation expectations in the United States.

- There is a 13% probability that the Fed will raise rates in June.

Today’s USD/CAD forecast is bullish. On Monday, the US dollar reached a five-week peak against major currencies. It rose due to concerns about inflation within the country and apprehensions about global economic growth. Furthermore, worries regarding the potential standoff over raising the US government’s borrowing limit of $31.4 trillion added to support the safe-haven dollar.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

On Friday, the Canadian dollar experienced a decline to its lowest point in eight days against the US dollar. This drop was because data revealed increased inflation expectations in the United States, raising investors’ concerns regarding a potential Fed rate hike.

Simultaneously, Wall Street stocks decreased due to the University of Michigan’s estimate reading on the overall consumer sentiment index, which reached a six-month low in May. Furthermore, the survey indicated a rise in the five-year inflation outlook to 3.2%, the highest reading since 2011.

The price of oil, a significant export for Canada, declined by 1.3% to $69.98 per barrel on Friday. This drop occurred as the market balanced concerns over supply with renewed economic uncertainties in the United States and China.

Meanwhile, the Bank of Canada’s Senior Loan Officer Survey data indicated a significant tightening of Canadian mortgage lending conditions during the year’s first quarter.

In January, the Canadian central bank raised its policy rate to a 15-year peak of 4.50%. However, it has maintained a hold on interest rates since then.

USD/CAD key events today

There are no key events scheduled for today in the US or Canada. Therefore, the pair will likely consolidate as investors watch for developments in the US debt ceiling impasse.

USD/CAD technical forecast: Corrective downside

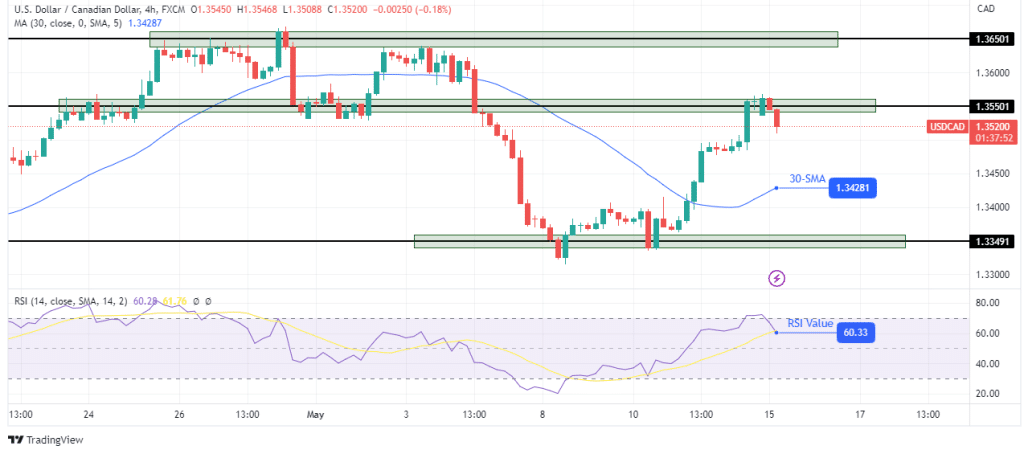

USD/CAD is pulling back in the 4-hour chart after retesting the 1.3550 resistance level. The bias is bullish because the price trades far above the 30-SMA with the RSI near the overbought region. The price will likely retrace the recent move and pause at or near the 30-SMA support.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

If bulls maintain control, the price will bounce higher to take out the 1.3550 after the retracement. A break above 1.3550 would allow the price to retest the next resistance level at 1.3650.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.