- USD/CAD bulls have stepped in to defend the breakout below the hourly rising trendline support.

- Price is on the verge of a test of the hourly counter trendline and 10-EMA.

- Eyes are on the BoC, US CPI and the Fed the following week.

USD/CAD is a touch lower as the North American session moves along trading at 1.2063 trading within a range of 1.2106 and 1.2057.

Risk appetite is has been weighed upon following US Treasury Secretary Yellen’s comments over the weekend.

In a Bloomberg interview, Treasury Secretary Janet Yellen said President Joe Biden should push forward with his $4 trillion spending plans even if they trigger inflation that persists into next year and higher interest rates.

The comments follow Friday’s slightly softer-than-expected US May Nonfarm Payrolls data which combined with such rhetoric stand to set the tone for the weeks ahead.

There are mixed takes on implications of both the jobs data and Yellen comments.

For instance, analysts at Brown Brothers Harriman wrote in the note, ”we do not believe that tapering discussions have been derailed by the jobs report”.

”Indeed, the data is unlikely to deter the Fed from discussing tapering at this meeting and the official statement and minutes should confirm this.”

”That said, the Fed is likely to remain in the early stages of such discussions and will refrain from setting out any sort of timetable until later this year.”

Looking forward, with respect to the US dollar, the June 16 Federal Open Market Committee meeting will be under the spotlight where the Fed would be expected to say that substantial progress towards its goals has not been achieved.

Beyond there, the key dates to watch for ahead are FOMC meetings July 27-28 and September 21-22, along with the Jackson Hole Symposium August 26-28.

However, for the immediate events for the week ahead, for one, we have the May US Consumer Price Index release and following last month’s reaction in FX and rates markets that looked through the jump in inflation, the same may be true this month.

Such an outcome would rhyme with the weekend comments from Yellen.

“If we ended up with a slightly higher interest rate environment it would actually be a plus for society’s point of view and the Fed’s point of view,” Yellen said Sunday in an interview with Bloomberg News during her return from the Group of Seven finance ministers’ meeting in London.

For two, the Bank of Canada will provide the highlight of a quiet week.

If there are no fireworks in Wednesday’s policy statement, traders will be looking to BoC’s Lane in an Economic Progress Report on Thursday for a potential catalyst instead.

From a positioning standpoint, net speculators’ long CAD positions recovered to their highest levels since Nov 2019 as the market maintains a reasonably hawkish road map for the BoC, analysts at Rabobank said.

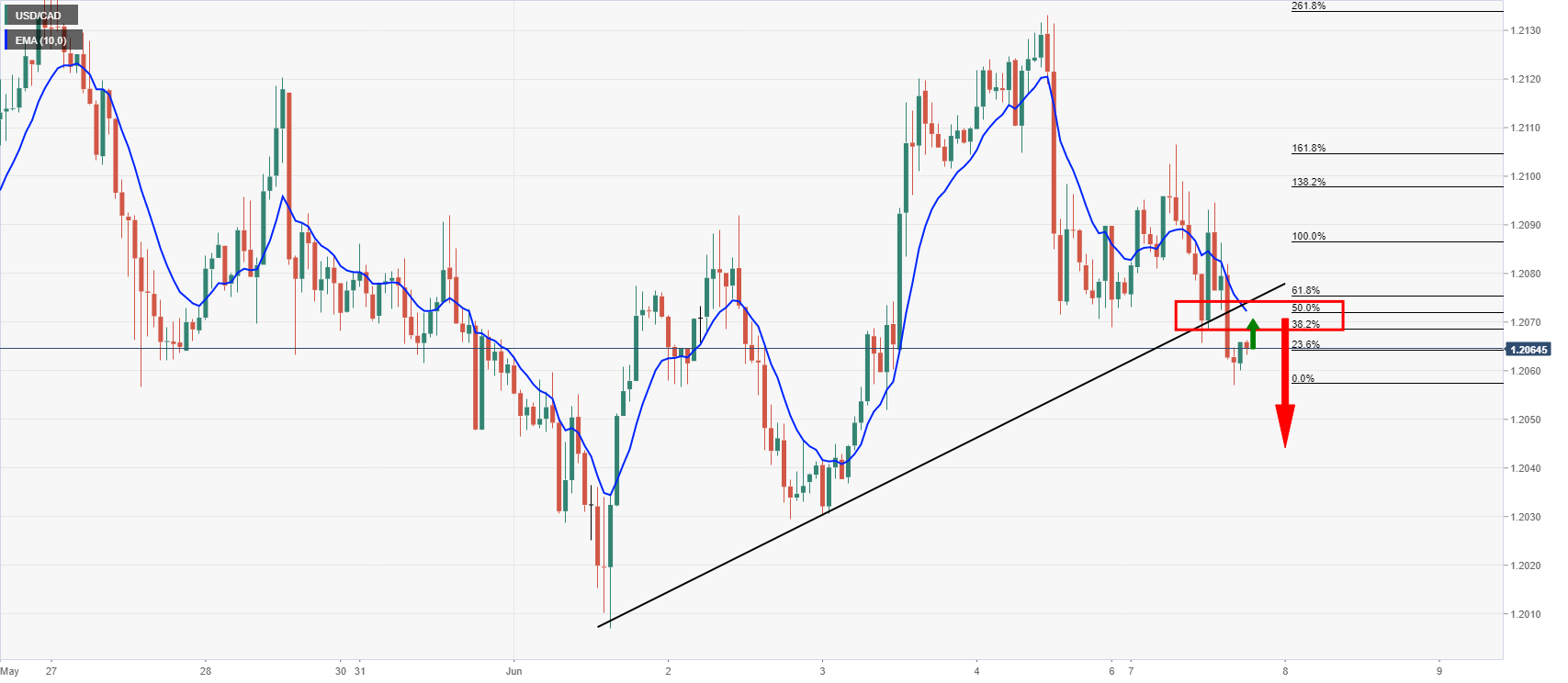

USD/CAD technical

USD/CAD is on the way to test a 38.2% Fibonacci retracement of the prior bearish impulse which aligns with the prior structure and near to the counter trendline that would be expected to act as resistance on a retest.

That being said, the structure guards a deeper retracement to the 61.8% Fibonacci that aligns with the neckline of the M-formation.

In either case, they could be the last stop before a downside continuation, in line with the broader strength of the Canadian dollar.