- USD/CAD extends decline in tandem with the US dollar.

- The bulls defending the critical support near 1.2715, for now.

- Focus shifts to the Canadian data and Treasury Sec. nominee Yellen.

USD/CAD extends the pullback from five-day tops into Tuesday, although the bears appear to take a breather following a steady decline from 1.2760.

The spot fell in tandem with the US dollar, as the return of risk-on flows weighed on the safe-haven demand for the greenback. Markets cheer calls for higher fiscal stimulus under Biden’s presidency after Treasury Secretary Nominee Janet Yellen urged Congress to do more to fight the pandemic recession.

On Monday, USD/CAD rallied hard and tested the 1.2800 level after the Canadian dollar was hit by the reports that Biden is expected to cancel the controversial Keystone XL Pipeline on his first day in office.

The pipeline is projected to carry oil nearly 1,200 miles (1,900km) from the Canadian province of Alberta down to Nebraska, to join an existing pipeline.

Markets now await the Canadian Manufacturing Sales data and Yellen’s inaugural speech as the Treasury Secretary due later in the NA session today for fresh trading directives.

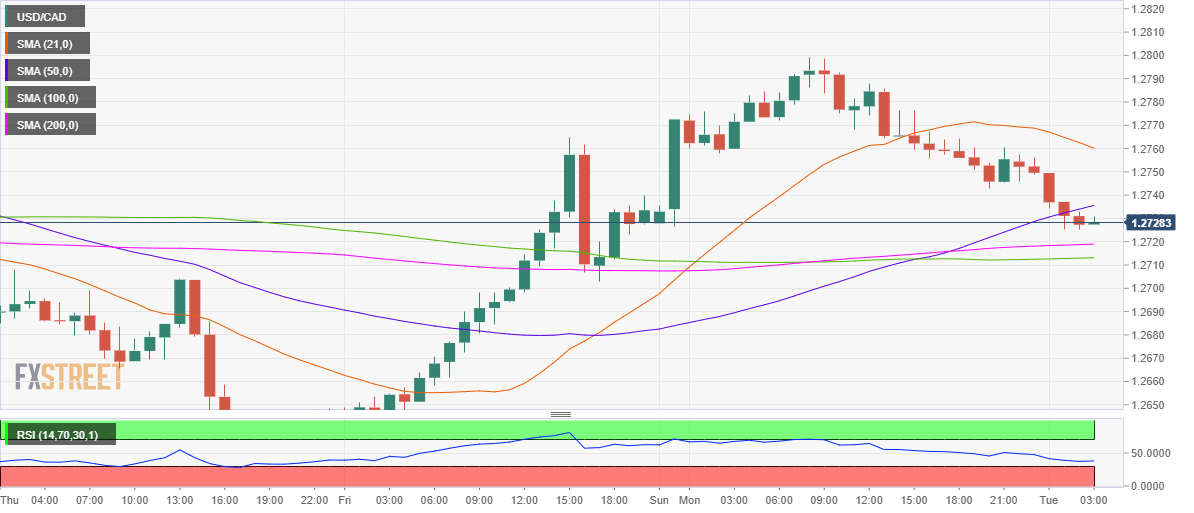

From a near-term technical perspective, the price has stalled its decline above the critical support near 1.2715, which is the confluence of the 200-hourly moving average (HMA) and 100-HMA.

The Relative Strength Index (RSI) has also taken a U-turn from lower levels, suggesting a brief bounce.

The bullish 50-HMA support now resistance at 1.2736 will be tested on the road to recovery. A break above the latter could expose the bearish 21-HMA barrier at 1.2760.

To the downside, a breach of the 1.2715 support could call for a test of the 1.2700 psychological level. The next relevant support is aligned at the January 13 low of 1.2680.

USD/CAD: Hourly chart

USD/CAD: Additional levels