USD/CAD has dropped below 1.3100 – the lowest since November 2018. The Canadian dollar has been on the rise, partially driven by oil prices. Where next

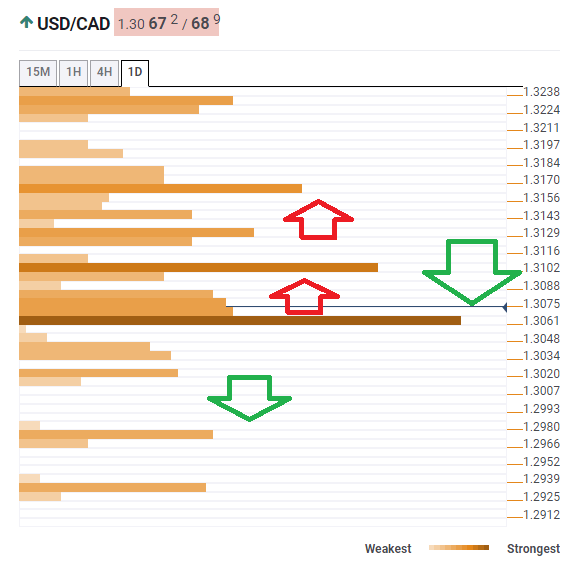

The Technical Confluences Indicator shows that USD/CAD is hovering above critical support at 1.3061 which is a dense cluster including the Bollinger Band 15min-lower, the BB 4h-lower, the previous monthly low, and the previous weekly low.

If the currency pair falls below this line, the next cushion is weak. 1.2973 is the next noteworthy cushion where the Pivot Point one-week Support 2 meets the PP 1d-S3.

Looking up, resistance awaits at 1.3102 which is the convergence of the Fibonacci 61.8% one-day, the Fibonacci 23.6% one-week, the BB 1h-Upper, the Simple Moving Average 5-1d, and the SMA 100-1h.

Further up, the next upside target is 1.3163 where we see the confluence of the Fibonacci 61.8% one-week, the Fibonacci 161.8% one-day, and the PP one-day R3.

Here is how it looks on the tool:

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.