- USD/CAD plunged to 1.2300 on hawkish BoC but found strong support.

- The WTI prices slipped for a second consecutive day, weighing on the Canadian dollar.

- Market participants are awaiting US GDP data today to find more opportunities.

The USD/CAD outlook remains slightly bullish as the price surges despite the hawkish BoC that had temporarily brought down the pair.

-Are you looking for automated trading? Check our detailed guide-

The USD/CAD price reached an intraday high of around 1.2375, up 0.18% over the day, as traders lashed out at the Bank of Canada (BOC) ahead of Thursday’s European meeting. In recent years, the Canadian pair has strengthened due to the decline in prices for the country’s largest export item – WTI crude oil.

As of writing, WTI crude is down more than 1.0% to $80.50, a two-week low. This marks the second day that black gold has fallen. Global traders fear a tightening of monetary policy in the West, while losses associated with the pandemic have yet to be identified.

The USD/CAD bulls also raise hopes for US economic stimulus and Fed hysteria. Optimists in the White House want more progress to stimulate growth while escalating disputes between the US and China over telecommunications, Taiwan and Afghanistan weigh on sentiment. Moreover, as the US prepares to release preliminary third-quarter GDP data, sentiment is also dubious. Those figures are designed to confirm that the world’s largest economy has been hit by the delta breakout, and therefore, this is not the right time for the Fed to hike rates.

The central bank left the base rate unchanged at 0.25%, in line with the general market forecast. After that, however, the central bank abruptly halted weekly purchases of government bonds. In addition, the Canadian dollar (CAD) rose on comments from Governor Tiff Macklem, who said, “We will consider raising rates sooner than we had anticipated.”

Against this backdrop, US Treasury bond yields consolidated their steepest daily decline since mid-August, pushing rates up to 1.55%, an increase of 2.6 basis points (bps), while stock futures gained modestly.

Mixed concerns underscore that oil moves are a major catalyst for USD/CAD gains, but it will be crucial to watch today’s US third-quarter GDP numbers.

– If you want to find out more about MT4 forex brokers, read our comprehensive guide –

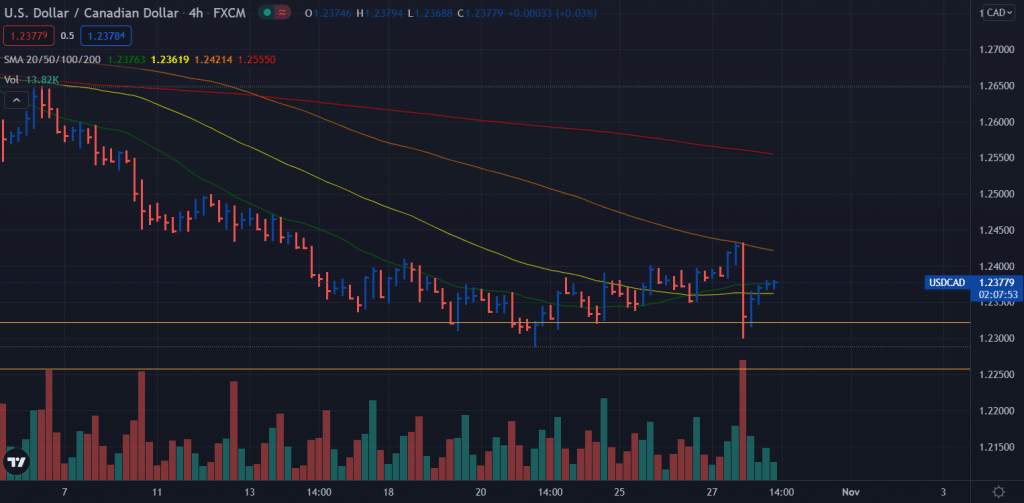

USD/CAD price technical outlook: Bulls eying 1.2400

The USD/CAD price tested the 1.2300 level yesterday and bounced back around 80 pips so far. The price is now around the 20-period SMA on the 4-hour chart. The upside attempt may test 1.2400 ahead of yesterday’s highs at 1.2430 area. On the flip side, 1.2350 will be the key support ahead of 1.2300. Overall, the volume is not supporting upside bias for now. Hence, it is prudent to wait for a decisive breakout before entering a position.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.