- Canada’s employment fell for a third consecutive month.

- Rising interest rates are beginning to cool Canada’s economy.

- Wage growth went up to 5.6% from 5.4%.

Today’s USD/CAD outlook is bearish. According to official data released on Friday, Canada’s employment declined for a third consecutive month in August, a sign that rising interest rates are beginning to cool the overheated economy. Economists, however, warned that this trend was unlikely to cause the BoC to pause its aggressive policy, boosting the Canadian dollar.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

According to Statistics Canada data, the Canadian economy lost 39,700 jobs in August, missing analyst predictions of an increase of 15,000 jobs. After reaching a record low of 4.9% in July, the unemployment rate increased to 5.4%, missing forecasts that it would go to 5.0%.

“I think this can be taken as a reasonable indication that the economy is slowing,” said Andrew Kelvin, chief Canada strategist at TD Securities.

“When you look at the increase in the unemployment rate, that does suggest that maybe a little bit of slack is starting to return to the labor market, though it’s not a complete process, and it will be a slow process,” he added.

Wage growth accelerated to 5.6% in August compared to July’s 5.4% increase. According to economists, the Bank of Canada will likely continue raising rates due to this wage pressure, which can further feed inflation.

USD/CAD key events today

There won’t be any significant economic releases from the US or Canada. The pair will likely continue moving on Friday’s momentum.

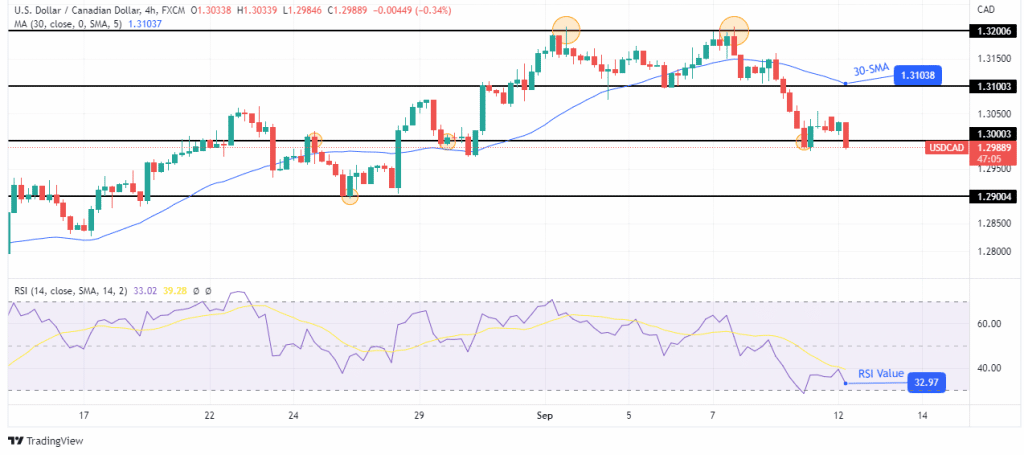

USD/CAD technical outlook: Double top playing out, bears headed for 1.29

Looking at the 4-hour chart, we see the price trading below the 30-SMA and the RSI well below 50. It is a sign that bears are in charge of the current move. This move comes after bulls could not go beyond 1.32006, where there was a double top pattern. The pattern indicated that bulls were no longer strong enough to make higher highs.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

The bearish trend started when the price broke below and retested the 30-SMA. Bears have broken below the 1.31003 support level and are currently on the verge of breaking below 1.30003, a key psychological level. If bears can successfully break below this level, the next target will be at the 1.29004 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.