- On Tuesday, the USD/CAD pair surged to a multi-week high, poised to gain further.

- As crude oil prices rose, the dollar gained strength, and the major suffered a blow.

- These factors should continue to support the US dollar and help contain the decline.

- Before a critical US CPI report, investors can also refrain from aggressive bets.

The USD/CAD outlook seems positive as the WTI prices are stable while the US dollar looks strong amid the hawkish Fed. The USD/CAD price pared most of its intraday gains to a four-week high and was last spotted around 1.2635, the bottom of its daily range.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Greenback is poised to gain further

The pair surged for a second straight day on Tuesday, which was also the fifth consecutive day of gains in the previous six days. US Dollar strength fueled the momentum, although rising Crude Oil prices supported the commodity-bound Canadian and capped the USD/CAD pair.

US dollar reached its highest level since May 2020 as expectations of more aggressive Fed tightening remained high. Comments by Chicago Fed President Charles Evans Monday that it would be worthwhile to discuss accelerated rate hikes to combat inflation bolstered the bets.

Firm WTI prices

While oil prices have increased modestly, traders have been reluctant to bet aggressively in this direction. Meanwhile, investors are concerned that the war in Ukraine and strict COVID-19 restrictions in China may impact global growth. This should keep the safe-haven dollar undisturbed and support the pair.

What’s next to watch?

As a result of this and fears that rising commodity prices will put pressure on already high consumer prices, US Treasury yields have reached multi-year highs and boosted the dollar. In the coming session, the market’s attention will be focused on the latest US consumer inflation data, which is expected later in the session.

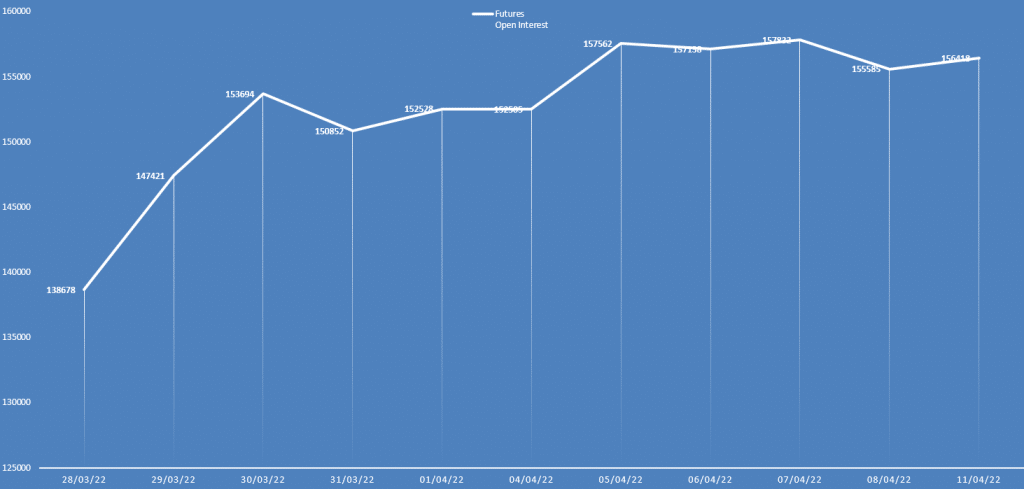

USD/CAD daily open interest outlook

The USD/CAD price went up on Monday while the daily open interest also rose. It means the bias is bullish.

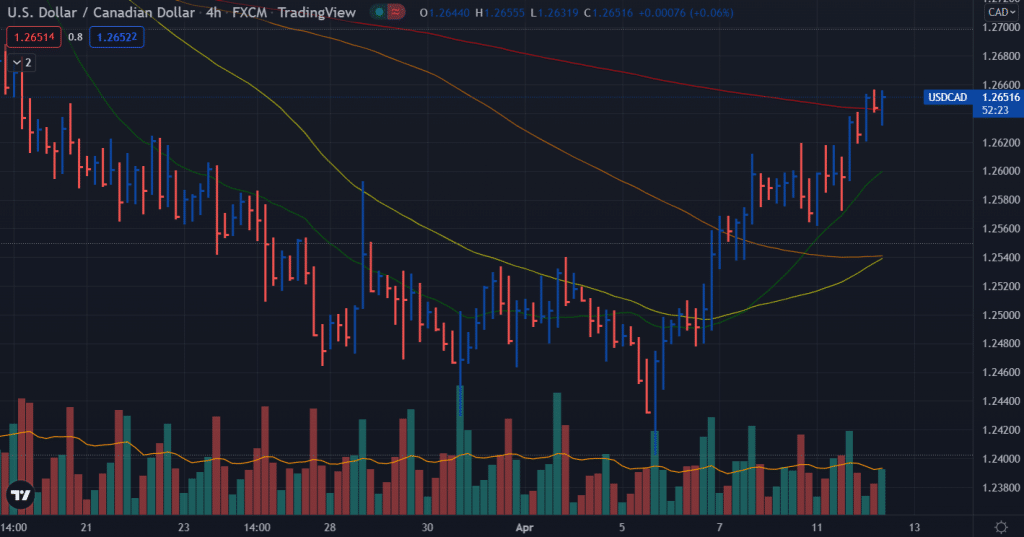

USD/CAD price technical outlook: Bulls above 200 SMA

The USD/CAD price has surpassed the 200-period SMA, while the bullish crossover between 20 and 50 SMAs are keeping bulls active. The 50 and 100 SMAs are also going to make a bullish crossover. This will be another sign of the upside continuation.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

However, the volume data is not quite supportive of the bulls. As the price is now consolidating gains, we should wait for a clear breakout before taking a position.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money