- Despite a strong rally, USD/CAD is facing tough resistance above the mid-1.2500 area.

- The Canadian dollar was weakened by the drop in oil prices.

- This week will be a big week for Canada’s unemployment rate.

The USD/CAD outlook is positive after the Fed’s policymakers left some hawkish comments. Meanwhile, the soft WTI prices are also weighing on the Canadian dollar.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

After experiencing a stronger buying reaction near 1.2400 round figure support, the USD/CAD price rallied strongly.

WTI prices slipping

Oil prices declined as a resulting rise in supply from the US. As a result of US President Joe Biden’s announcement that 180 million barrels would be released from the Special Petroleum Reserve (SPR) in the next six months, oil prices have turned bearish. There has been a significant impact on the Canadian dollar due to the fall in oil prices since Canada is the top oil exporter to the US.

Recent FOMC minutes

Moreover, hawkish comments from policymakers of the Federal Reserve System (FRS) strengthened the US dollar after some time. According to the FOMC minutes for March on Wednesday, the Fed will hike rates by 50 basis points (bp) this year. In addition, Fed Chairman Jerome Powell has promised to raise rates by half a percentage point on two of the seven occasions.

What’s next to watch for the USD/CAD outlook?

Statistic Canada’s unemployment data will be released on Friday and will likely have a major impact on the asset. Compared to the previous estimate of 5.5%, the preliminary unemployment rate is 5.4%.

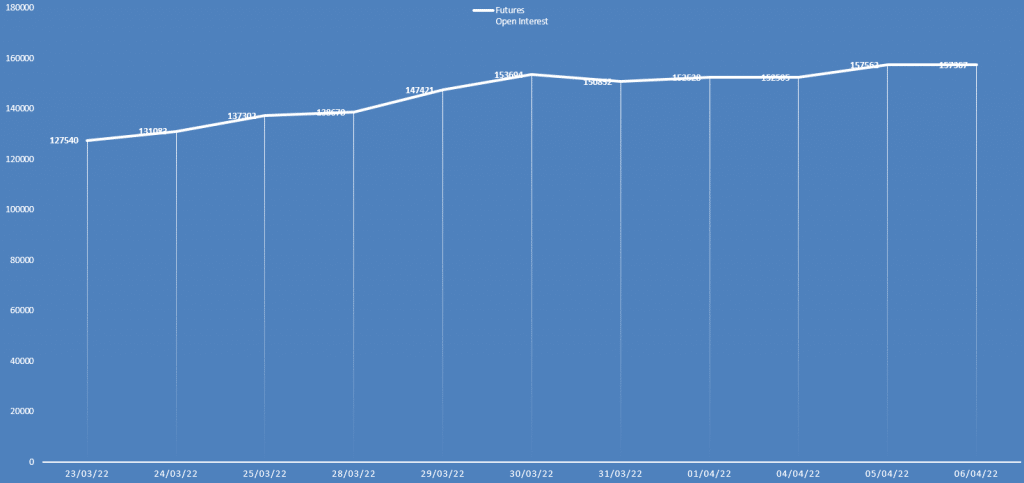

USD/CAD daily open interest

The USD/CAD price saw a significant rise yesterday. On the other hand, the daily open interest also rose. It indicates that new buyers have entered the market. Hence, the bias is bullish now.

USD/CAD price technical outlook: Bulls take charge

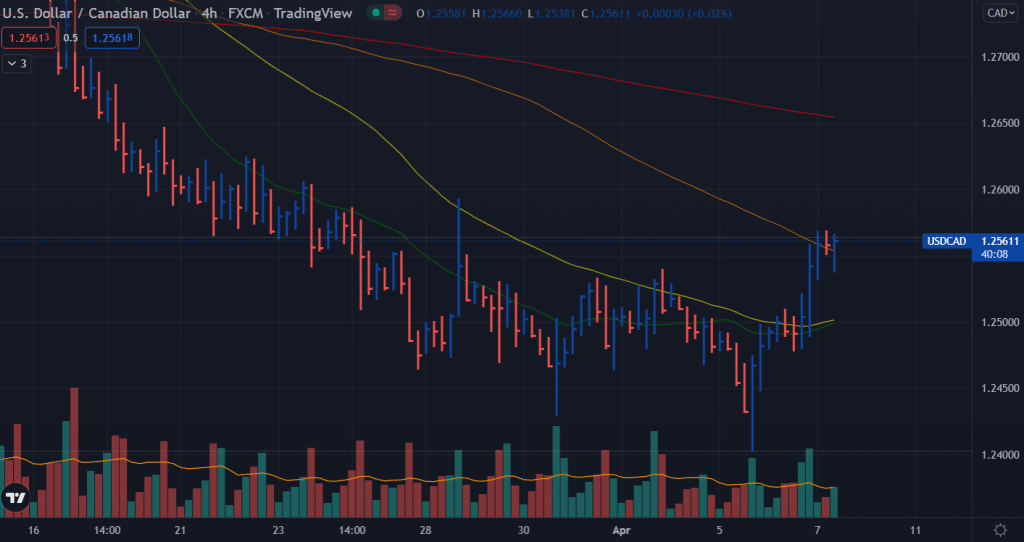

The USD/CAD price posted solid gains above the 1.2500 level. In addition, the pair managed to soar above the 20 and 50 SMAs on the 4-hour chart. However, the bulls have found a tough resistance around the 100-period SMA.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

The volume data is positive for the pair. However, the recent consolidation has a very low volume, indicating that the market is looking for a catalyst to find further fresh impetus. Any further buying will find resistance at 1.2590 (previous swing high). On the other hand, the downside move may find support around 1.2500 ahead of 1.2400.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money