- US inflation figures came in lower than anticipated, fueling speculation of a peak.

- Markets are now pricing a 71.5% chance of a 50bps rate hike in December.

- The BoC stated on Thursday that Canada’s booming labor market could withstand an economic downturn.

Today’s USD/CAD outlook is bearish. The dollar sank on Friday as US inflation figures came in lower than anticipated, fueling market speculation that inflation may have peaked and that the Federal Reserve may start walking away from its hefty interest rate rises.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

According to data, the consumer price index increased 7.7% year on year in October, less than expected (8% increase) and the smallest increase since January. The announcement caused the dollar to decline overnight.

“The overnight moves in the dollar were pretty sharp … I think the results in the US CPI for October will support the case for a downshift in the FOMC rate hike in December,” said Carol Kong, a currency strategist at Commonwealth Bank of Australia.

Fed funds futures indicate that, compared to a nearly even likelihood a week ago, markets are now pricing in a 71.5% chance of a 50-basis-point rate increase and a 28.5% possibility of a 75-basis-point increase at the Fed’s December meeting.

Before another anticipated interest rate increase, the BoC stated on Thursday that Canada’s booming labor market could withstand an economic downturn without experiencing a significant spike in unemployment. Governor Tiff Macklem has yet to rule out another significant increase at the next meeting on December 7.

USD/CAD key events today

There won’t be any significant news releases from the US or Canada today. Therefore, investors will keep digesting yesterday’s US inflation data.

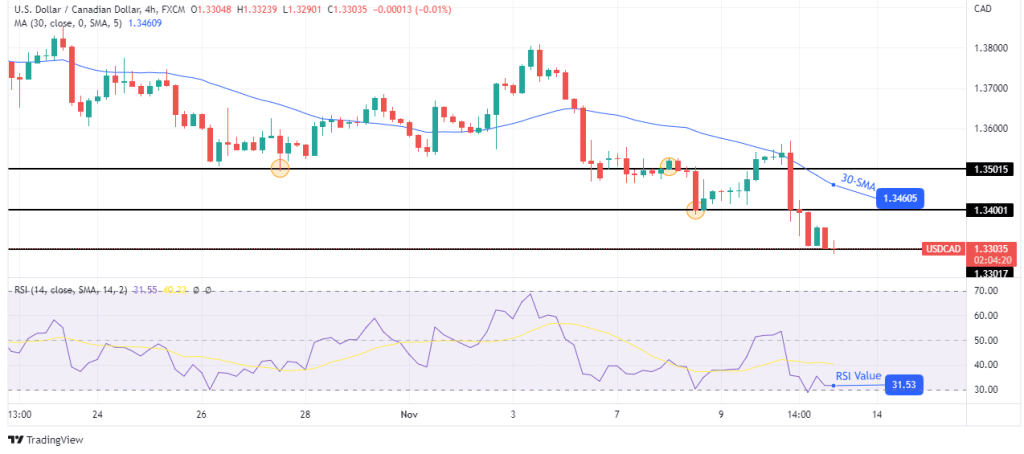

USD/CAD technical outlook: Bears push for new lows below 30-SMA

Looking at the 4-hour chart, we see the price trading well below the 30-SMA and the RSI below 50, showing bears are holding the reins. Bears are stronger than bulls, as shown in the candlestick sizes.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

After the price found support at the 1.3400 level, bulls came in to retest the 30-SMA. However, they made small-bodied candles, showing they struggled to increase prices. When bears took over at the SMA, the move was stronger as the price made large-bodied candles. The price also broke through the previous support at 1.3400, making new lows. If bears maintain this strength, the price will likely outweigh the 1.3301 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.