- The Bank of Canada raised its overnight rate to a 22-year high of 4.75%.

- The Canadian dollar reached its strongest level in four weeks at 1.3322.

- The Bank of Canada expects inflation to decelerate to 3% during the summer.

Today’s USD/CAD outlook is bearish. The US dollar decreased against the Canadian dollar, following a 0.24% decline on Wednesday. Surprisingly, the Bank of Canada raised its overnight rate to a 22-year high of 4.75%. Consequently, this prompted immediate market and analyst expectations of another increase next month.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

After a series of eight interest rate hikes since March 2022, which brought borrowing costs to a 15-year high of 4.50%, the central bank had paused since January to assess the impact of the previous adjustments.

However, there was surprisingly robust consumer spending, a rebound in service demand, increased housing activity, and a tight labor market. This indicated that excess demand was more enduring than anticipated, as stated by the central bank.

Due to the rise in inflation in April, concerns grew that CPI inflation could significantly exceed the 2% target. Given these circumstances, the governing council concluded that the current monetary policy lacked the necessary restrictiveness to sustainably bring inflation back to the 2% goal.

The Canadian dollar reached its strongest level in four weeks at 1.3322. Money markets currently assign a 60% probability of another rate hike in July, with further tightening fully priced in by September.

Moreover, the Bank of Canada expects inflation to decelerate to 3% during the summer. However, it did not reiterate its previous forecast from April, which projected a gradual decline to reach its 2% target by the end of next year.

USD/CAD key events today

The initial jobless claims report coming from the US will give the market insight into the state of the US labor market.

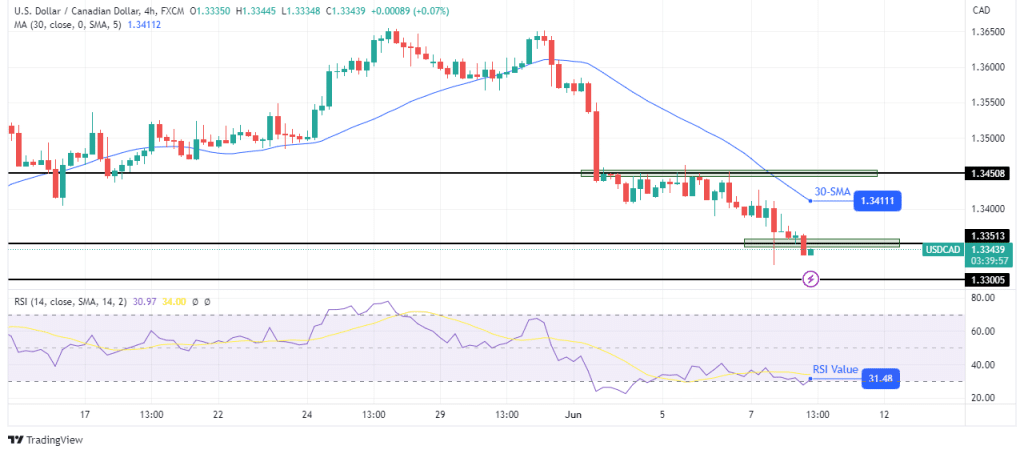

USD/CAD technical outlook: Bears ready to retest the 1.3300 support.

After a bit of weakness, bears have become stronger in the 4-hour chart. This strength has pushed the price below the 1.3351 support level and farther below the 30-SMA. Additionally, the RSI is near the oversold region, showing near-extreme bearish momentum.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

The price has closed below the 1.3351 support level, allowing bears to target the 1.3300 key support level. The bearish bias will only change when bulls break above the 30-SMA resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money