- USD/CAD was aggressively sold on Friday due to several factors.

- The rising oil price supported the Canadian dollar and put pressure on the weakening US dollar.

- Inflation data for the US and Canada are expected to provide significant momentum for traders.

During the European session, the USD/CAD outlook fell to a three-day low near 1.2725, extending its severe intraday losses.

On the last day of the week, spot prices declined sharply from the 1.2875-1.2880 range, the highest levels since March 9th, with aggressive selling. As a result, the USD/CAD price fell for the third day in a row today as factors contributed to its decline.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

The safe-haven US dollar has broken a six-day winning streak to a five-year high following a protracted reversal in risk sentiment. In addition, rising crude oil prices supported the commodity-pegged Canadian dollar and weighed on the USD/CAD pair.

Crude prices were supported by fears that sanctions against Russia, the world’s second-largest exporter, would cut supply. Further, the possibility that Germany will join other European Union member states in an embargo on Russian oil has provided a modest boost to the black liquid.

Nevertheless, any significant increase in crude prices should be limited by concerns that prolonged COVID-19 lockdowns could dampen fuel demand. Meanwhile, a deteriorating outlook for the global economy and the prospect of aggressive Fed tightening should help limit losses for the safe-haven dollar.

The fundamentals favor the bulls of the US dollar and support the prospect of bearish buying around USD/CAD.

What’s next to watch for the USD/CAD?

Investors are now awaiting Friday’s economic report, which will focus on releasing the US core PCE index – the Fed’s preferred inflation gauge – and Canada’s GDP report. In addition, traders can take advantage of short-term opportunities by watching the USD/CAD and USD/Oil price action.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

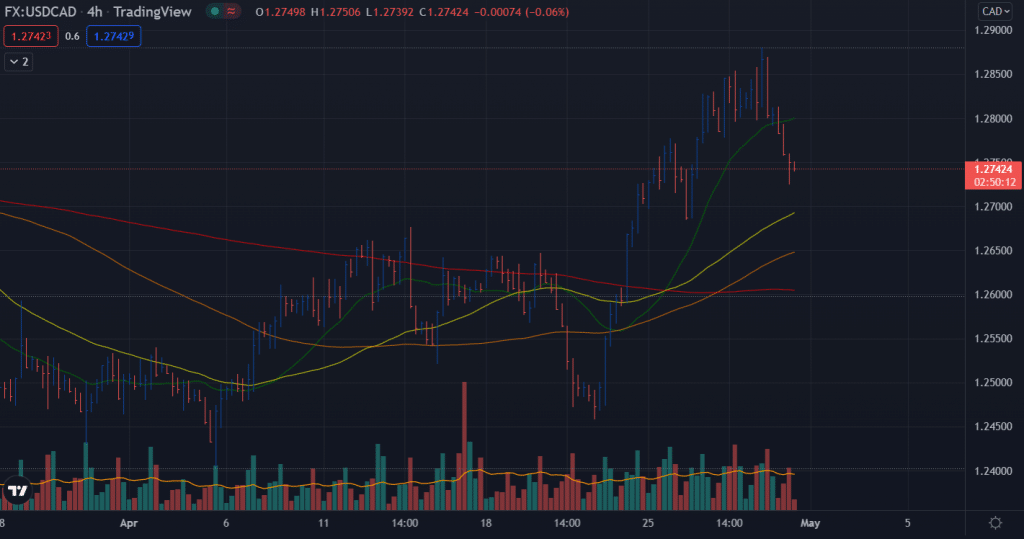

USD/CAD price technical outlook: Bears aiming for 50-SMA

The USD/CAD price posted a widespread down bar with a massive volume on the 4-hour chart. The pair further slipped below the 20-period SMA. It shows that the room for bearish correction persists. The pair is likely to hit the 50-period SMA around 1.2690.

The volume bars for the recent dip are on the rise. It indicates that the trend is clearly bearish, and the probability of further downside remains high.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money