- US economic data showed a persistently tight labor market.

- Initial jobless claims in the US fell to a three-month low last week.

- In November, Canada had a trade imbalance of C$41 million ($30.20 million).

Today’s USD/CAD outlook is bullish as dollar strength continues. On Friday, the dollar maintained close to a one-month high as US economic data showed a persistently tight labor market that could keep the Federal Reserve on its aggressive rate-hike path.

-Are you looking for automated trading? Check our detailed guide-

According to figures released on Thursday, the number of Americans submitting new applications for unemployment benefits fell to a three-month low last week, while the number of layoffs decreased by 43%.

Separate data showed that private employment rose by 235,000 jobs in the past month, greatly above forecasts of a 150,000-job growth.

Markets are now focusing on the closely anticipated nonfarm payrolls report, scheduled for release later Friday. According to experts surveyed by Reuters, the US economy added 200,000 jobs in December.

According to figures released by Statistics Canada on Thursday, Canada had a trade imbalance of C$41 million ($30.20 million) in November due to falling energy product exports and imports of medicines and other consumer items.

Analysts had predicted a C$610 million surplus in November; instead, there was a deficit.

According to Stephen Brown, a senior Canada economist at Capital Economics, the preliminary GDP estimate for November is subject to “downside risks” due to the data released on Thursday.

In a preliminary estimate released last month, Statscan predicted that the Canadian economy expanded at the same rate in October and November, presumably by 0.1%.

USD/CAD key events today

Investors are expecting employment data from the US and Canada. The US will release the nonfarm payroll data and unemployment rate, while Canada will release employment change data and the unemployment rate. Both countries will also release PMI data.

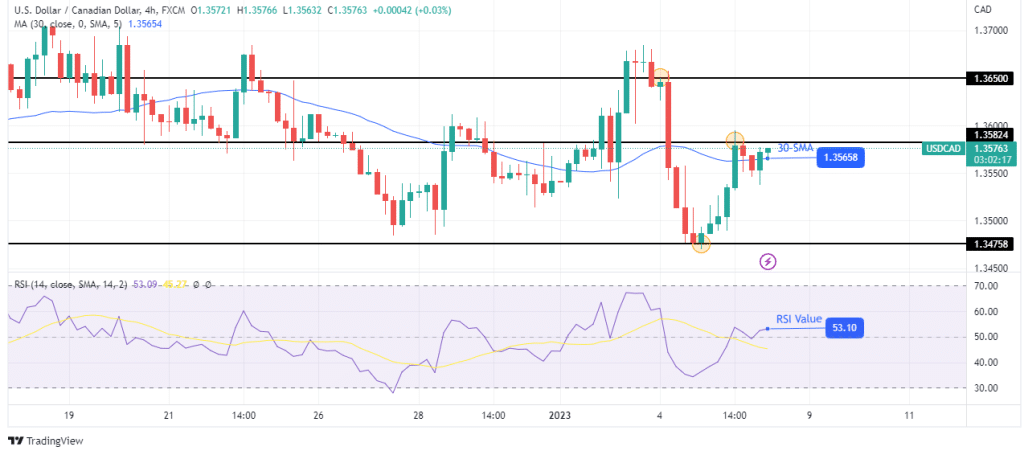

USD/CAD technical outlook: Bulls prepare to break above the 1.3582 resistance

The 4-hour chart shows USD/CAD in a bullish move paused at the 1.3582 resistance. The price is trading slightly above the 30-SMA after a short pullback and is about to retest the resistance level. If bulls are still stronger, the price will likely break above 1.3582 and rise to the next resistance level at 1.3650.

-If you are interested in forex day trading then have a read of our guide to getting started-

However, if bulls fail to break above, bears will return, pushing the price lower to retest the 1.3475 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.