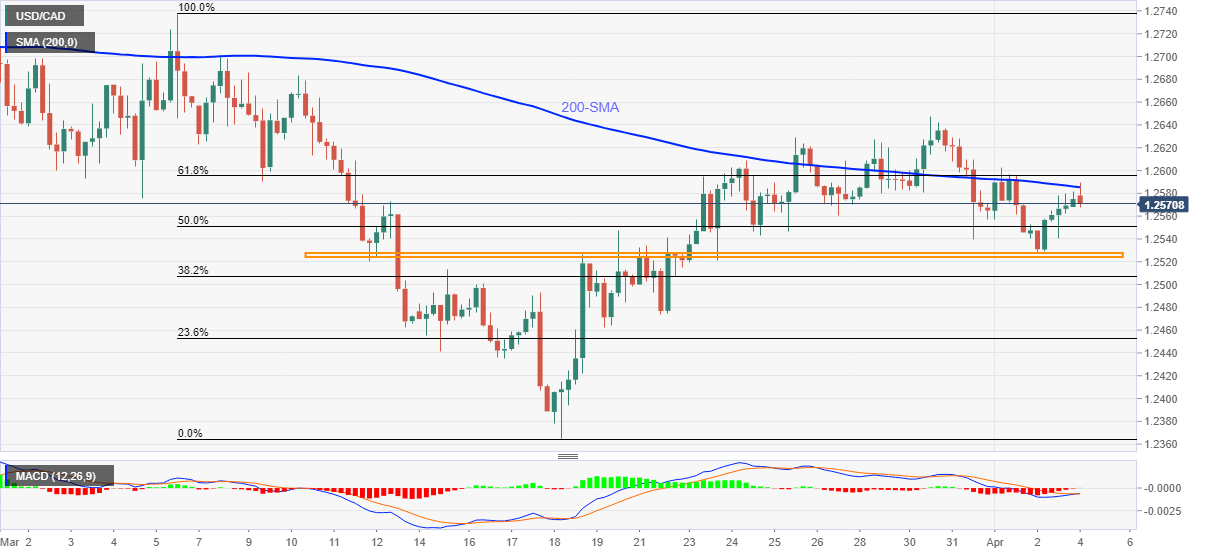

- USD/CAD bounces off intraday low following another pullback from 200-SMA.

- MACD flirts with the bulls, three-week-old horizontal support restricts short-term downside.

- 61.8% Fibonacci retracement level, late March’s top add to the upside barriers.

After a downbeat start to the week, USD/CAD prints corrective pullback to 1.2573 during the initial Asian session on Monday.

In doing so, the loonie pair eyes another confrontation with the 200-SMA, around 1.2585, backed by the MACD signals that recently trim bearish bias.

It should, however, be noted that 61.8% Fibonacci retracement of March 05-08 declines and the March 30 high, respectively near 1.2595 and 1.2650, could test the bulls USD/CAD bulls during the quote’s further upside.

In a case where the quote rallies past-1.2650, the previous month’s peak surrounding 1.2740 will be the key to watch.

Meanwhile, the fresh pullback may take rest close to the 50% Fibonacci retracement level of 1.2550 before highlighting the 1.2530-25 support area comprising multiple levels marked since March 12.

Although USD/CAD is likely to reverse from 1.2525, failures to do so may not hesitate to recall the mid-1.2400s on the chart.

USD/CAD four-hour chart

Trend: Further recovery expected