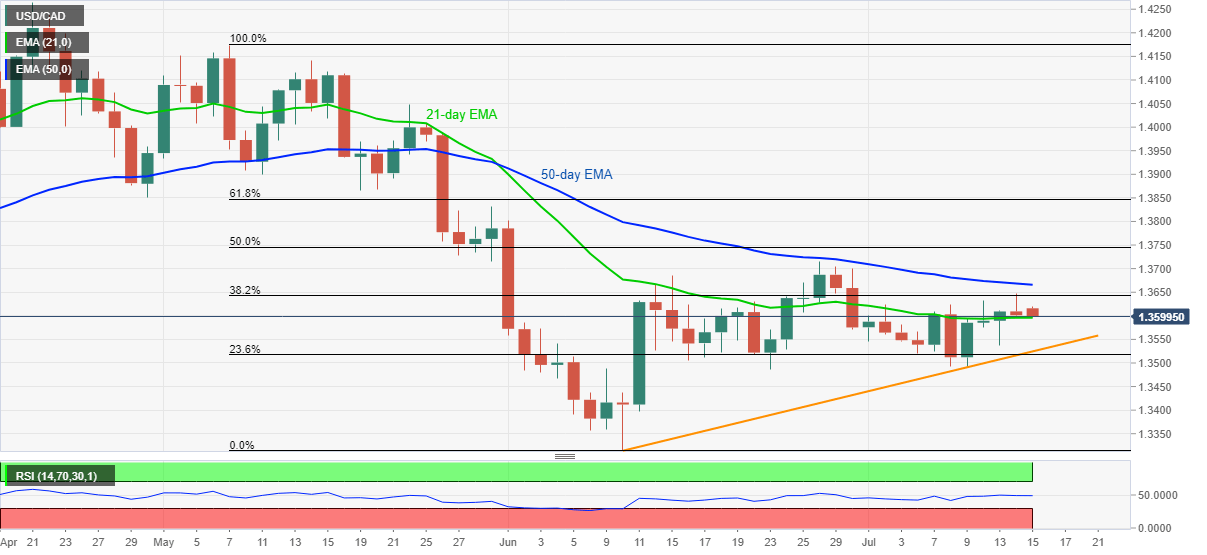

- USD/CAD remains depressed despite the latest bounce off 1.3595.

- 50-day EMA offers strong resistance, a five-week-old support line adds to the support.

- Repeated failures to rise past-50-day EMA joins normal RSI to favor the sellers.

USD/CAD trades around 1.3600 amid the early Asian session on Wednesday. The loonie pair remains on the back foot for the second day while testing 21-day EMA. The quote earlier refreshed the monthly high to 1.3646 on Tuesday but failed to cross 50-day EMA.

Considering the bulls’ inability to cross 50-day EMA, coupled with normal RSI conditions, the USD/CAD prices are likely to remain downbeat.

However, sellers are waiting for a clear break below the 21-day EMA level of 1.3595 to beat the optimism. In doing so, an upward sloping trend line from June 10, at 1.3525 now, will be on their radars.

During the quote’s additional weakness past-1.3525, 1.3490/85 area, comprising the monthly bottom near 1.3490, becomes the key support zone.

On the contrary, the pair’s successful trading above 50-day EMA level of 1.3665 could quickly pierce 1.3700 round-figures to aim for June 26 top near 1.3715. Though, 50% Fibonacci retracement of May-June fall around 1.3745 will challenge the quote’s further upside.

USD/CAD daily chart

Trend: Further weakness expected