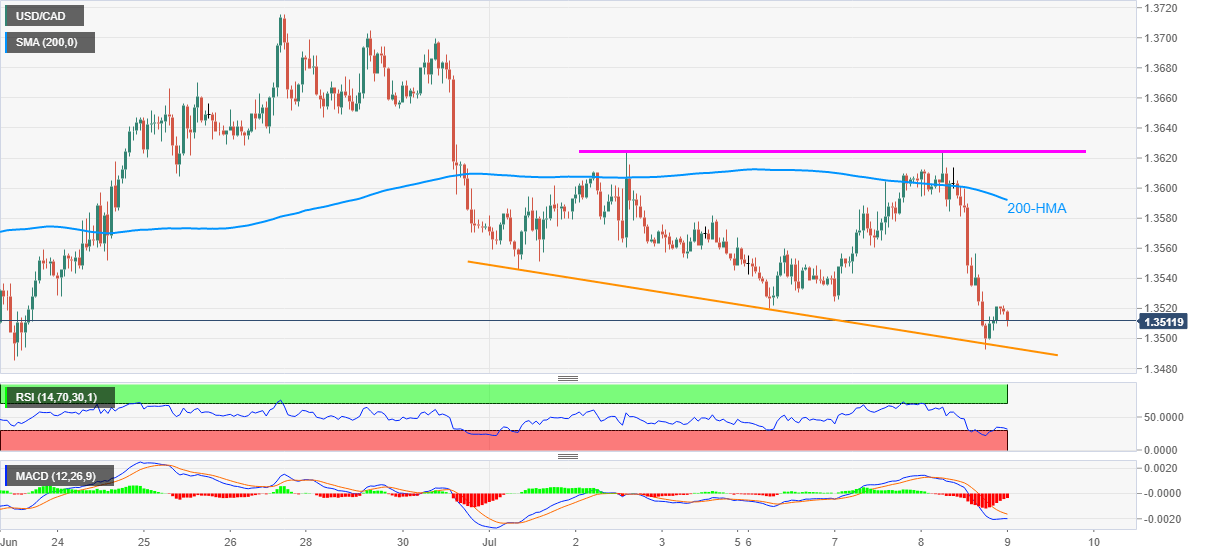

- USD/CAD fails to stretch pullback moves from 1.3493 beyond 1.3522.

- Bearish MACD, failures to regain above 1.3500 favor the sellers.

- Oversold RSI might trigger another U-turn from the immediate trend line support.

USD/CAD drops to 1.3510 during the initial hour of Tokyo open on Thursday. In doing so, the pair defies recoveries from 1.3493, following a U-turn from 1.3522. The loonie pair declines to a 12-day low the previous day. However, oversold RSI conditions and a falling trend line from July 01 restricted the quote’s downside despite bearish signals from the MACD.

Against this backdrop, the quote is likely to extend near-term weakness towards revisiting the immediate support line, currently around 1.3495.

However, oversold RSI conditions could restrict further downside around 1.3490/85 area comprising the late-June lows.

On the upside, a clear break above 1.3525 can aim for 1.3560 and 200-HMA level of 1.3593 before attacking 1.3600 round figure.

During the pair’s sustained rise past-1.3600 mark, the current monthly near 1.3625 will be the key to watch.

USD/CAD hourly chart

Trend: Bearish