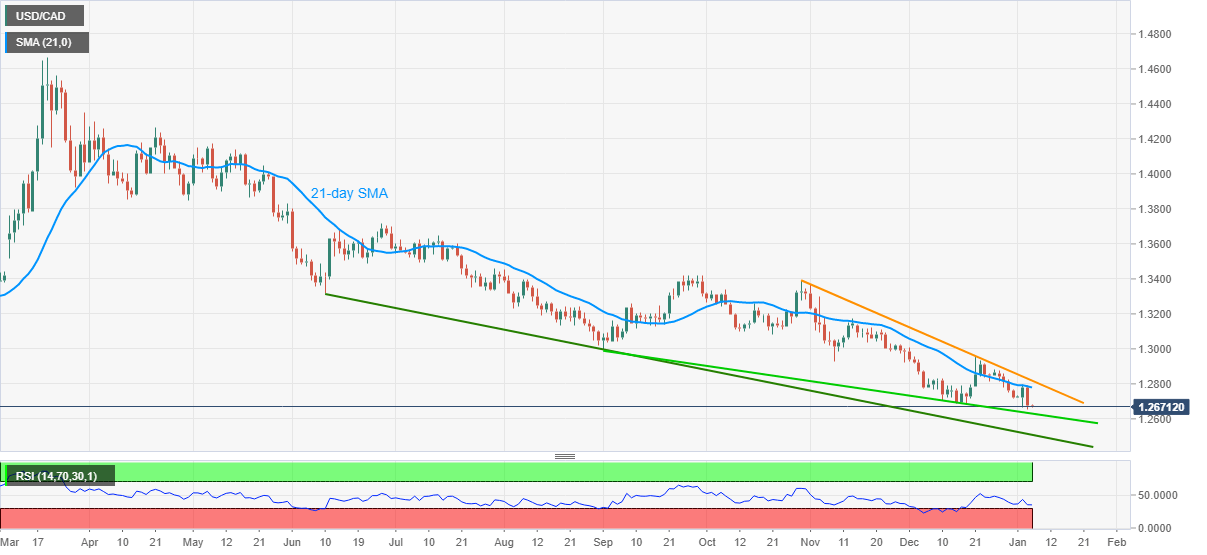

- USD/CAD retraces from fresh low since April 2018, marked on Tuesday.

- Absence of oversold RSI, sustained trading below 21-day SMA favor sellers.

- Downward sloping trend line from October 29 adds to the upside barriers.

USD/CAD keeps corrective pullback from the multi-month low while taking rounds to 1.2670 during the early Asian session on Wednesday. The loonie pair dropped to the fresh 33-month low the previous day while portraying its U-turn from 21-day SMA.

Even so, the RSI conditions aren’t oversold and favor the quote’s sustained trading below 21-day SMA.

As a result, a descending support line from September 01, currently around 1.2630 lures the USD/CAD sellers ahead of April 2018 low near 1.2525.

It should, however, be noted that a seven-month-long falling trend line, at 1.2507 now, will be a tough nut to break for USD/CAD bears past-1.2525.

Meanwhile, the 1.2700 threshold offers immediate resistance to USD/CAD ahead of the 21-day SMA level of 1.2780.

If at all USD/CAD buyers manage to cross 1.2780, a short-term resistance line stretched from late-October, around 1.2820, offers an extra challenge to regain the market’s confidence.

USD/CAD daily chart

Trend: Bearish