- USD/CAD remains depressed while extending pullback from two weeks’ top.

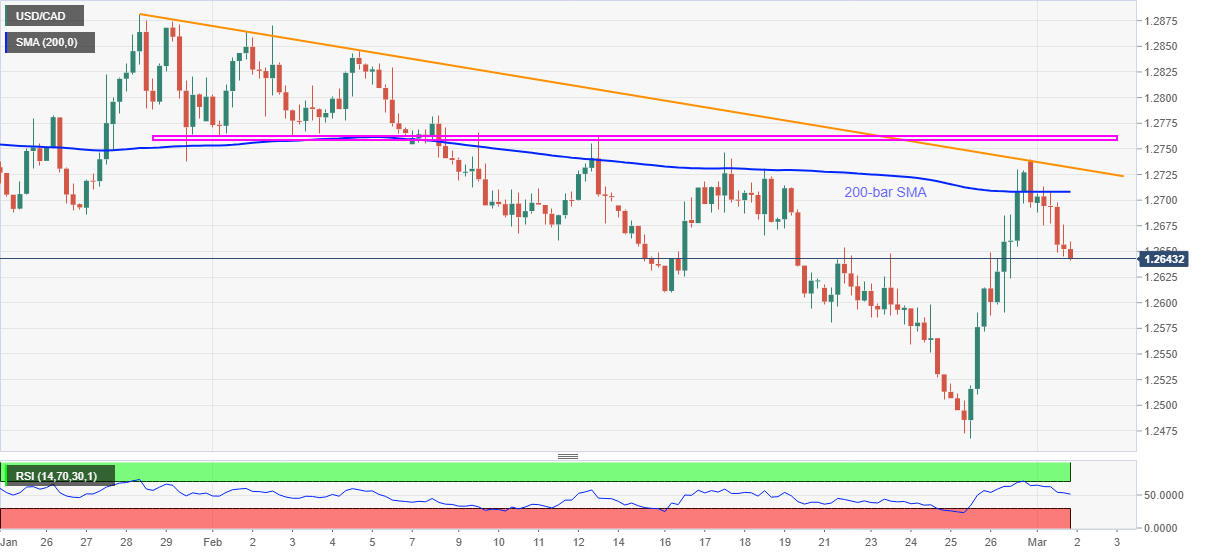

- Sustained trading below key trend line, 200-bar SMA, amid normal RSI, favors bears.

- Horizontal area from late January adds to the upside filters.

USD/CAD drops to 1.2641, down 0.10% intraday, amid the initial Asian session on Tuesday. In doing so, the loonie pair extends the previous day’s downbeat performance while portraying a u-turn from the five-week-old falling trend line as well as declining below 200-bar SMA.

Given the latest downside lacks oversold RSI conditions, the bears still have room for further gains.

As a result, the mid-February lows around the 1.2600 threshold gain attention as the immediate support.

Though, any further weakness will need to break the 1.2580 support before challenging Thursday’s multi-month low near 1.2468.

Meanwhile, the 1.2700 round-figure can offer immediate resistance to the USD/CAD prices ahead of the 200-bar SMA level of 1.2708.

During the quote’s sustained run-up beyond the key SMA, the aforementioned resistance line around 1.2730 and multiple tops and bottoms since January 29, close to 1.2760, will challenge the USD/CAD buyers.

USD/CAD four-hour chart

Trend: Bearish