- USD/CAD pair continues its fall as the WTI price rises to $80, the highest since 2014.

- The Canadian jobs data is positive as compared to the jobs report of the US.

- Risk aversion may resist the bears and provide a temporary lift to the pair.

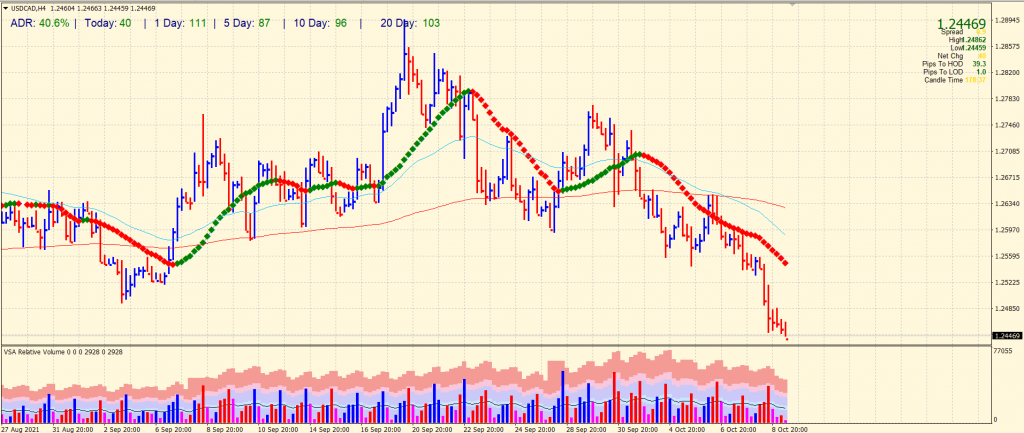

The USD/CAD price analysis reveals the downtrend started on Friday, hitting multi-day lows around 1.2445, down 0.11% during the day before Monday’s European session.

If you are interested in trading USD/CAD with forex robots, check out our guide.

At the same time, the loonie currency pair recorded fresh lows amid a rise in WTI crude oil to multi-month highs, the country’s most important export product. Jobs figures in Ottawa were also better than those in Washington.

The price of West Texas Intermediate crude rose to its highest point since 2014, up 1.60% to $ 80.40 at the time of publication as markets expect supply disruptions in Central America as Tropical Storm Pamela passes through the Gulf of Mexico. Positive headlines regarding the price of black gold may also refer to measures to boost the US economy and hopes for economic recovery after the pandemic.

The September US employment report supported the USD/CAD bears, whether it was the change in employment in Canada, the unemployment rate, or the average hourly wage, the September US employment report supported the USD/CAD bears.

The US non-farm sector (NFP) posted 194,000 jobs instead of the expected 500,000. Nevertheless, the previous figure was revised upward by 366,000 jobs. In the same period, the unemployment rate fell from 5.1% to 4.8%, down from 5.1% as expected, while a decrease from 0.4% to 0.6% was seen in the average hourly gain.

The unemployment rate in Canada was 6.9%, up from 7.1% earlier. At the same time, the net change in employment exceeded the forecast from 65K to 157.1K, and average hourly wages increased from 1% to 1.70% in September.

In addition to oil prices helping the USD/CAD bears, the US and Canadian holidays are fueling mixed fears of another Fed cut to test further declines in the pair. Additionally, risk aversion supports the demand for the US dollar as a safe haven and exacerbates negative filters on the pair.

If you are interested in Automated forex trading, check our detailed guide-

USD/CAD price technical analysis: Bears holding dominance

The USD/CAD price is consolidating near the lows at the mid-1.2400 area. The volume reveals a pause in the bearish momentum for now. However, there is still no clue for the bulls to appear. The pair has covered only 40% average daily run. The price remains well below the 20-period SMA on the 4-hour chart. Further decline may lead to a 1.2400 area. On the upside, 1.2500 may provide initial resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.