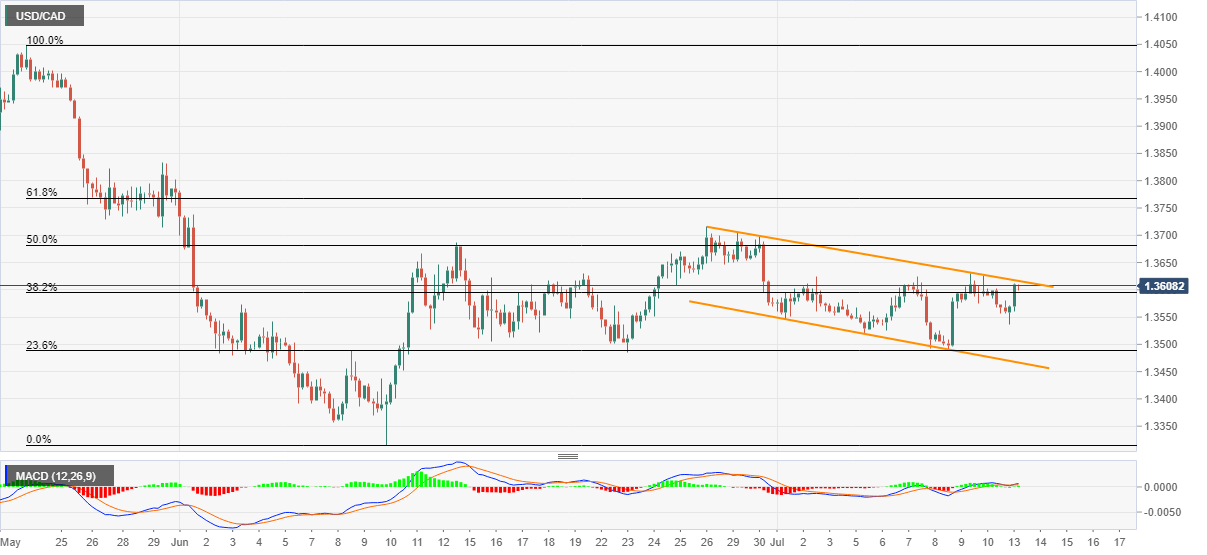

- USD/CAD struggles to defy the pullback from 1.3612.

- A clear break above the short-term channel will need validations from the key Fibonacci retracement levels.

- 1.3490/85 can offer strong intermediate support ahead of the channel’s lower line.

USD/CAD wavers around 1.3605, after stepping back from 1.3612, during the early Asian session on Tuesday. In doing so, the pair attempts extension of the late-US session recovery from 1.3536. Though, a short-term descending trend channel formation keeps the bears hopeful.

As a result, the sellers will enter on the pair’s firm weakness below 1.3600 while aiming 1.3540 as an immediate target. However, multiple bounce-points around 23.6% Fibonacci retracement of the pair’s May 22 to June 10 fall, around 1.3490/85, could challenge further downside.

Additionally, the support line of the mentioned channel, near 1.3465, becomes an extra hardship for the bears.

On the contrary, buyers will wait for a clear rise past-1.3620 level, comprising the channel’s upper line, to target a 50% Fibonacci retracement level of 1.3681.

During the quote’s rise past-1.3681, the late-June top surrounding 1.3715 and 61.8% Fibonacci retracement close to 1.3770 will be in the spotlight.

USD/CAD four-hour chart

Trend: Pullback expected