- USD/CAD picks up bids after rising for two consecutive days.

- Normal RSI conditions, sustained recovery moves from 1.2630 favor bulls.

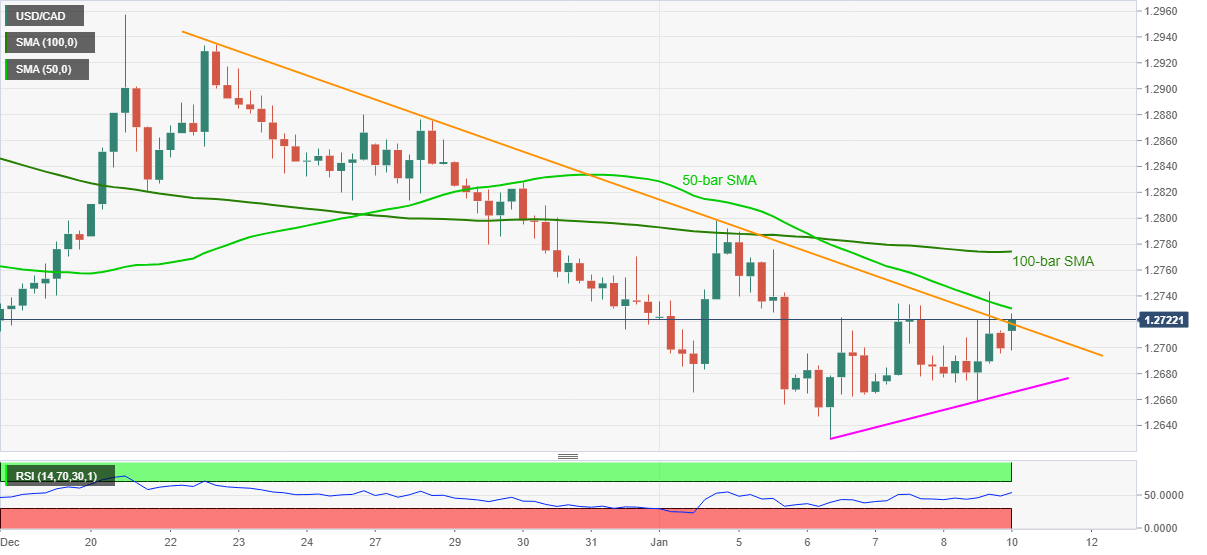

- Key SMAs add to upside filters above three-week-old resistance line.

USD/CAD rises to 1.2715, up 0.05% intraday, during Monday’s Asian session. In doing so, the loonie pair extends the latest corrective pullback from 1.2630, marked on late-Wednesday, towards a downward sloping trend line from December 22.

Considering the absence of overbought RSI conditions, coupled with the latest recovery moves, USD/CAD is likely to cross the stated resistance line, at 1.2725 now, while eyeing the 50-day SMA level of 1.2730.

However, 100-bar SMA near 1.2775 and a monthly high around 1.2800 will be tough challenges for the USD/CAD buyers past-1.2730.

On the contrary, the 1.2700 round-figure and an upward sloping trend line from last Wednesday, close to 1.2665, will be the key to watch for USD/CAD sellers during the fresh declines.

Though, any strong weakness past-1.2665 will need to break the recently flashed multi-month low of 1.2630 before convincing the medium-term bears.

Overall, USD/CAD is up for a corrective pullback but the bears haven’t yet accepted the defeat and hence traders should be cautious.

USD/CAD four-hour chart

Trend: Further recovery expected