- USD/CAD carries recovery moves from 1.3316 to clear short-term upside barrier.

- The quote takes the bids near two-day top amid bullish MACD signals.

- March month low offers strong downside support below 1.3360/55.

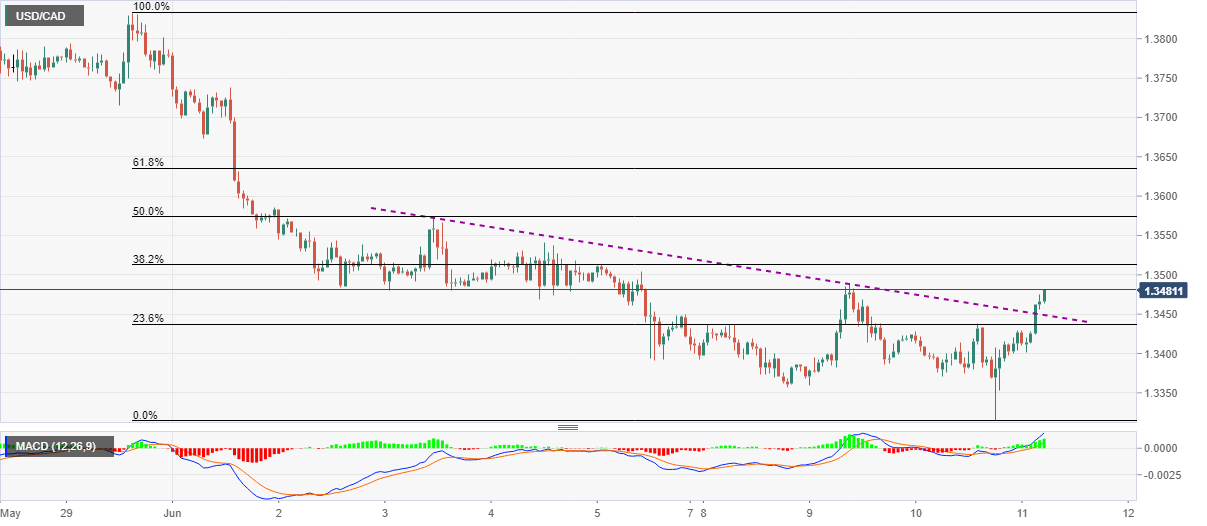

USD/CAD is rising to 1.3475, up 0.47% on a day, ahead of the European session on Thursday. The pair Loonie pair’s run-up takes clues from its ability to cross a falling trend line from June 06. Also favoring the buyers could be the bullish MACD conditions.

Against this backdrop, the quote escalates the pullback from 1.3316 towards 1.3500. However, multiple stops around 1.3480/85 might question the immediate upside.

In a case where the USD/CAD prices remain strong beyond 1.3500, June 03 top near 1.3575 and 61.8% Fibonacci retracement of May 29 to June 10 fall, at 1.3635, could lure the optimists.

Meanwhile, the pair’s downside break below the previous resistance line, at 1.3445 now, could recall 1.3400 and 1.3360/55 on the charts.

During the bears’ dominance past-1.3355, March 2020 low near 1.3315 becomes the key as a break of which can divert sellers toward 1.3200 threshold.

USD/CAD hourly chart

Trend: Further recovery expected