- US data showed softening wage pressure.

- The US central bank is set to increase interest rates by 25 basis points.

- Canada’s economy likely stalled in December after expanding somewhat in November.

Today’s USD/CAD price analysis is bearish. With investors eagerly expecting the outcome of a Federal Reserve policy meeting, the dollar was generally weak versus major currencies on Wednesday after falling in the previous session in response to US data that showed softening wage pressure.

–Are you interested in learning more about forex robots? Check our detailed guide-

Later on, Wednesday, the US central bank is set to increase interest rates by 25 basis points. However, traders will likely focus on Fed Chair Jerome Powell’s press conference to determine how long the Fed will likely remain hawkish.

Data released on Tuesday indicated that Canada’s economy likely stalled in December after expanding somewhat in November, which was in line with predictions. The Bank of Canada predicted that the economy would stagnate for the year’s first half.

According to Statistics Canada, the GDP increased by 0.1% in November and is predicted to remain flat in December.

In the fourth quarter, the annualized gross domestic product most likely increased by 1.6%, exceeding the Bank of Canada’s prediction of 1.3%. If the flash estimate is accurate, the economy will have grown by 3.8% from the previous year in 2022, exceeding the central bank’s expectation of 3.6%.

The Bank of Canada announced last week that it would probably delay further rate rises.

USD/CAD key events today

Investors will pay close attention to data releases from the US, including job reports, PMI data, and the FOMC meeting. These will likely cause a lot of volatility in the pair.

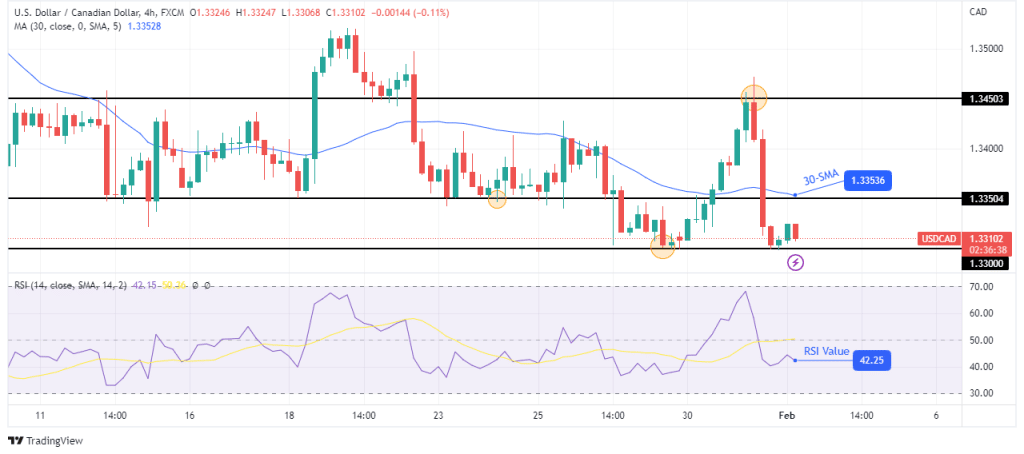

USD/CAD technical price analysis: Bears to crack 1.3300 support

The 4-hour chart shows USD/CAD trading below the 30-SMA and the RSI below 50. This comes after a whiplash move that saw the price get to the 1.3450 resistance level and back to the 1.3300 support in a short time.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

This is a sign that there was almost equal strength between bears and bulls. If this continues, the price will likely bounce higher from 1.3300 and surpass 30-SMA.

However, if bears hold on to control, we might see a small pullback to the 1.3350 resistance before the price breaks below 1.3300 and pushes lower.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money