- Canadian retail sales decreased by 0.5% in September from August.

- Canada’s flash estimates indicated that sales increased by 1.5% in October.

- The Bank of Canada stated that higher interest rates were beginning to slow the Canadian economy.

Today’s USD/CAD price analysis is slightly bearish. The Canadian dollar strengthened versus the US dollar as investors’ risk appetite increased, and domestic data showed retail sales increased in October.

-Are you interested in learning about the forex signals telegram group? Click here for details-

According to Statistics Canada data, Canadian retail sales decreased by 0.5% in September from August, which was expected and was primarily due to fewer sales at petrol stations. Flash estimates, however, indicated that sales increased by 1.5% in October. Wholesale trade increased by 1.3%, and manufacturing sales increased by 2%.

One of Canada’s main exports, oil, increased after top exporter Saudi Arabia stated OPEC+ would continue to limit supply and perhaps take other measures to restore market balance, further supporting the Canadian dollar.

On Tuesday, the Bank of Canada stated that higher interest rates were beginning to slow the Canadian economy, exerting pressure on households with high debt levels. The Bank increased interest rates by 50 basis points last month to combat excessive inflation, bringing the policy rate to 3.75%, the highest level since January 2008, when it was at 4%.

At the Bank of Canada’s upcoming policy decision on December 7, the money markets have priced in an additional 25 basis points of tightening and anticipate a 20% likelihood of a greater move of 50 basis points.

USD/CAD key events today

Investors will pay attention to the United States, which is set to release several significant reports. These include building permits, core durable goods orders, initial jobless claims, new home sales, and the FOMC minutes.

USD/CAD technical price analysis: Battle for control at the 30-SMA support

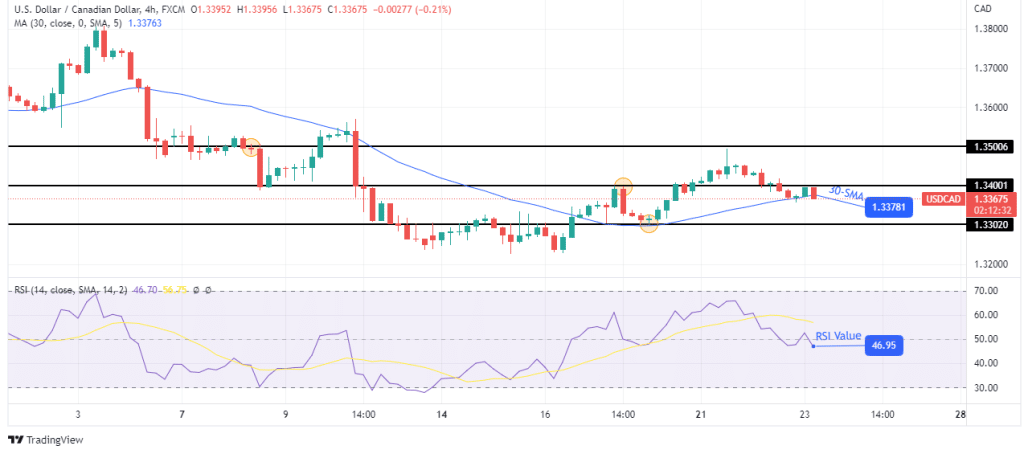

Looking at the 4-hour chart, we see the price trading close to the 30-SMA and the RSI slightly below 50. This is an area of almost equal strength where bears have a bit more momentum than bulls.

–Are you interested in learning more about making money with forex? Check our detailed guide-

However, bulls might have an advantage given the bullish trend, with the price making higher highs and higher lows. If the 30-SMA support holds, the price will bounce off and head for the 1.3500 resistance level. However, if the bears win this battle, the price will likely retest the 1.3302 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.