- USD/CAD price remains well supported on the day as the US dollar gains some momentum.

- A surge in oil prices may hamper the rally in the USD/CAD pair.

- The hawkish stance of the Fed may keep the US dollar stronger.

The USD/CAD price analysis suggests a bullish momentum towards the 1.2440 area as the US dollar remains supported amid the hawkish Fed.

-If you are interested in high leveraged brokers, check our detailed guide-

Nearly 30 pips have been recovered since the lows of the early European session, and the pair trades just a few pips below the region’s daily highs of 1.2370.

Since last week’s modest price rally from the four-month low, the pair has struggled to benefit from it, and it continued its limited price movement on Monday for the second session in a row. Recently, oil prices have surged to multi-year highs, supporting the commodity-pegged Canadian dollar. However, the absence of any significant buying around the US dollar created a drag on the USD/CAD pair.

An important factor contributing to the pressure on the safe dollar was the prevailing risk appetite. While US Treasury yields rose amid an approaching Fed tightening, the USD/CAD pair received some support from the rise in interest rates. Jerome Powell, chairman of the Federal Reserve, confirmed that the US Federal Reserve is further reducing its massive incentives during the pandemic.

The inflation rate is also expected to rise in 2022 due to the recent surge in commodity prices. In spite of this, the markets appear to have fully factored in the Fed’s hawkish expectations since aggressive interest rates could deter dollar bulls. Therefore, to confirm that USDCAD has bottomed shortly, one should wait for strong follow-up buying.

The US and Canada are not expected to release any major economic data on Monday. Therefore, US bond yields and general market risk sentiment will emphasize the demand for the US dollar and boost momentum for the USD/CAD pair. In addition, traders will focus on oil price dynamics in the future to capitalize on some short-term opportunities surrounding the major currency.

-If you are interested in MT5 brokers, check our detailed guide-

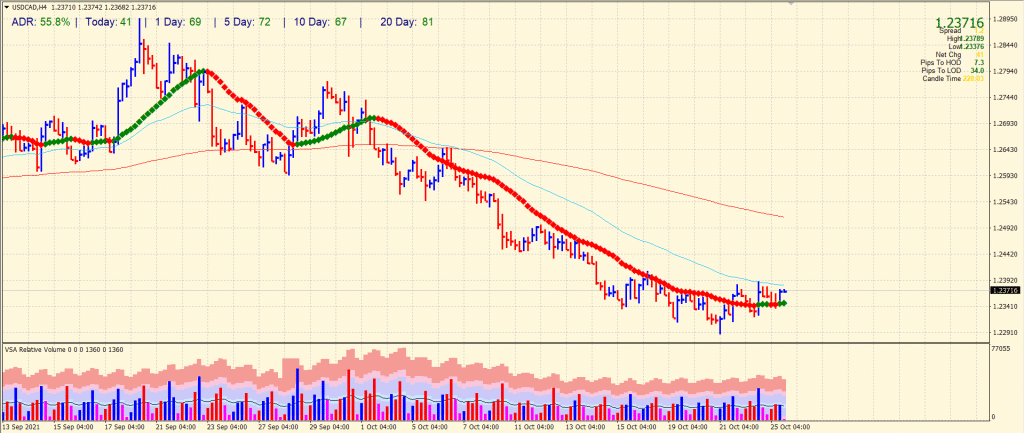

USD/CAD price technical analysis: 20-SMA to support a further rise

The USD/CAD price remains supported by the 20-period SMA on the 4-hour chart. However, the 50-period SMA is hampering the rise. The average daily range is only 55% which shows low volatility on the day. Any further upside move will find a hurdle around the horizontal level at 1.2440 ahead of 200-period SMA at 1.2510 area. On the flip side, 1.2290 – 1.2310 remains a strong demand zone ahead of 1.2250.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.