- USD/CAD continued with its struggle to find acceptance above the 1.2500 round-figure mark.

- The overnight move beyond the 1.2460-50 confluence hurdle seems to favour bullish traders.

- A sustained move beyond the 1.2525 region is needed to confirm the near-term positive bias.

The USD/CAD pair struggled to capitalize on the previous day’s solid rebound from multi-year lows and seesawed between tepid gains/minor losses through the mid-European session. The pair was last seen trading just below the key 1.2500 psychological mark, nearly unchanged for the day.

A modest pullback in the US Treasury bond yields held the US dollar bulls from placing aggressive bets. Apart from this, rebounding crude oil prices underpinned the commodity-linked currency – the loonie – and further collaborated towards capping any further gains for the USD/CAD pair.

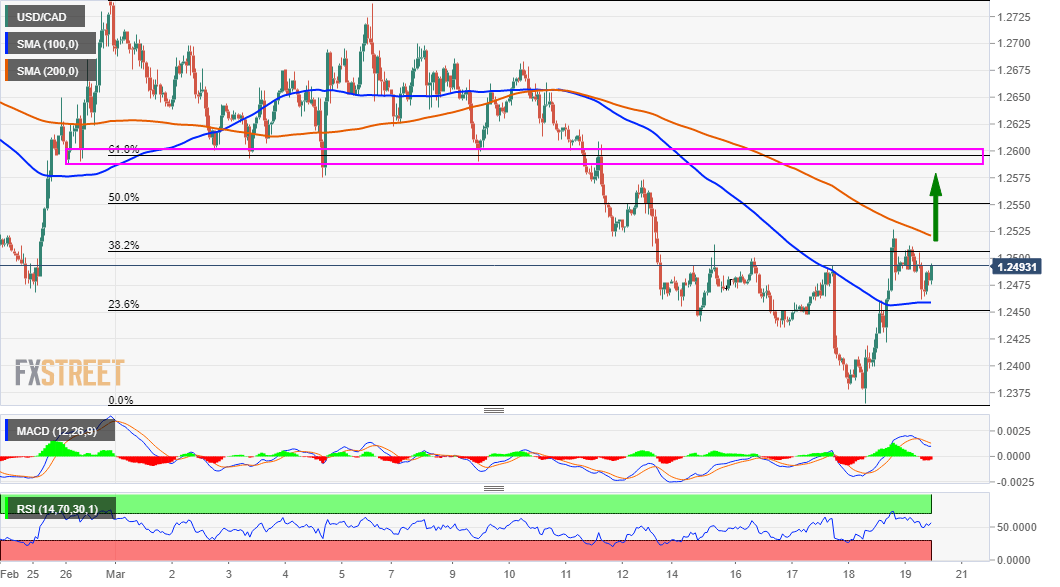

Looking at the technical picture, the overnight strong move up pushed the USD/CAD pair beyond the 1.2455-60 confluence resistance. The mentioned barrier comprised of 100-hour SMA and the 23.6% Fibonacci level of the 1.2740-1.2365 recent fall to the lowest level since February 2018.

Meanwhile, an intraday slide on Friday managed to find some support near the mentioned resistance breakpoint. This, in turn, should now act as a key pivotal point for traders and help determine the near-term trajectory as investors look forward to Canadian Retail Sales data for a fresh impetus.

From current levels, the 1.2500 mark, coinciding with the 38.2% Fibo. level might continue to act as immediate resistance and is closely followed by the overnight swing high, around the 1.2525 region. The latter also marks the 200-hour SMA, which if cleared will set the stage for additional gains.

The USD/CAD pair might then aim to surpass the 50% Fibo. level and aim to test the 1.2575-80 horizontal support breakpoint, now turned resistance. Some follow-through buying has the potential to lift the pair further towards the 61.8% Fibo. level, around the 1.2600 round-figure.

On the flip side, the 1.2450-40 confluence region might continue to protect the immediate downside. Failure to defend the mentioned support will negate any near-term positive bias and turn the USD/CAD pair vulnerable to slide below the 1.2400 mark, to retest multi-year lows near the 1.2365 region.

USD/CAD 1-hourly chart

Technical levels to watch