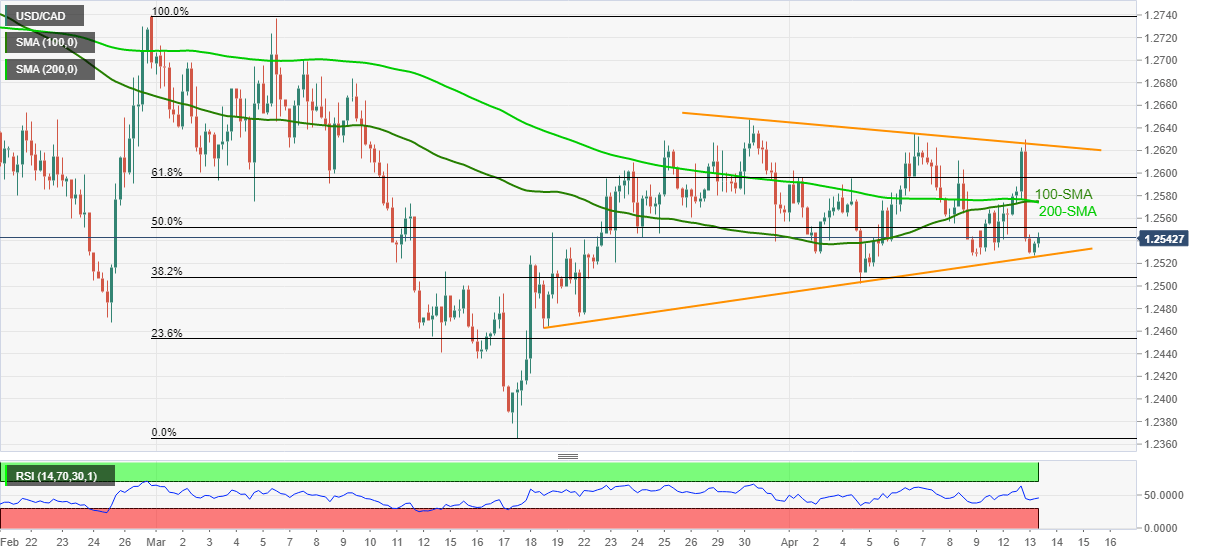

- USD/CAD eases from intraday high while keeping the bounce off short-term support line.

- 100, 200-SMA confluence and a falling trend line from March 30 test the bulls.

- Monthly bottom adds to the downside filters, extended consolidation more likely.

USD/CAD steps back from the day’s high of 1.2547 to 1.2541 amid early Wednesday. Even so, the loonie pair keeps its U-turn from an ascending support line from March 19.

Given the absence of extreme RSI conditions, the pair’s latest bounce off the key support is likely to cross 50% Fibonacci retracement level of late February to March 18 downside, around 1.2555.

However, any further rise will have to cross a convergence of 100 and 200-SMA near 1.2575, a break of which should push USD/CAD bulls toward attacking the two-week-old resistance line, around 1.2625.

Meanwhile, a downside break of the 1.2525 support line isn’t an open call to the USD/CAD bears as the monthly low surrounding the 1.2500 threshold should test the quote’s further weakness.

To sum up, USD/CAD is in a consolidation mode inside a symmetrical triangle, which in turn suggests the latest corrective pullback to continue.

USD/CAD four-hour chart

Trend: Further recovery expected