- The dollar is on track for its largest weekly gain since February.

- Concerns over the US debt ceiling and worries about the banking sector remain.

- The Canadian dollar dropped significantly due to the fall in oil prices.

Today’s USD/CAD price analysis is bullish. The US dollar rose on Friday and was on track for the largest weekly gain since February. Market analysts believe the dollar may have benefited from its reputation as a safe-haven asset this week. Investors were concerned about the US debt ceiling and the banking sector.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

PacWest, a US bank, reported a substantial drop in deposits, causing its shares to plummet by 23% on Thursday.

Analysts also attribute the dollar’s increase to a potential rebound from a period of weakness, though the overall trend is still negative. The greenback has experienced a decline of more than 11% since it reached a 20-year high last year and has fallen in seven out of the last nine weeks.

On Thursday, the Canadian dollar dropped significantly against the US dollar due to the fall in oil prices and disappointing US economic data. The number of jobless Americans who filed for unemployment benefits hit a high point last week. There was also a modest increase in producer prices in April, signaling a weakening economy.

Economists predict that these trends could lead to a recession by the end of 3023. This is a significant concern for Canada, which relies on exports to the US, including oil. Oil prices declined by 2.3%, partly due to the political impasse over the US debt ceiling and concerns about the banking sector.

USD/CAD key events today

No key releases are lined up for today from the US or Canada. Investors will likely focus on developments in the US debt ceiling discussions.

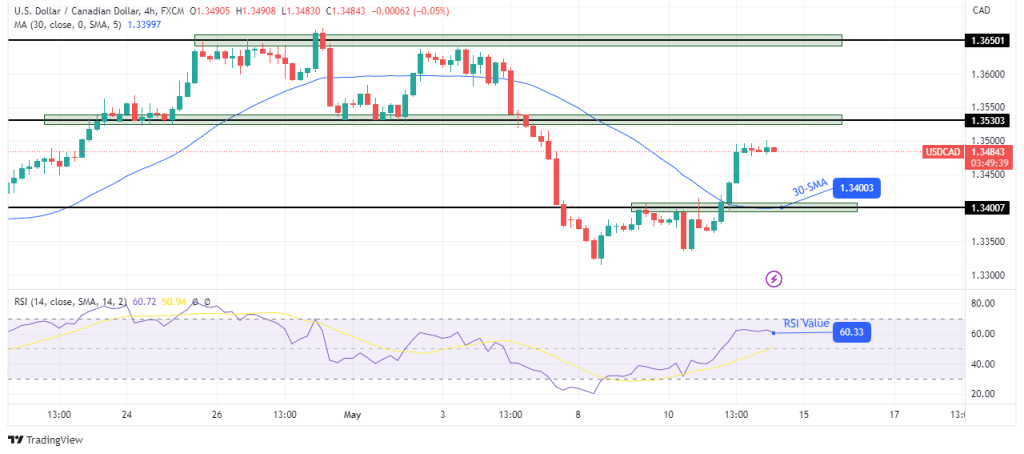

USD/CAD technical price analysis: Bulls take control, aiming for 1.3530.

On the charts, there has been a shift in sentiment to bullish. The price has broken above the 30-SMA, indicating bulls have taken over from bears. At the same time, there is stronger bullish momentum as the RSI trades above 50.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

After a sharp bullish move, the price has paused and is consolidating. We might get a deeper pullback, but the bias will stay bullish if the price respects the 30-SMA support. From here, bulls will likely retest the next resistance at 1.3650.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money