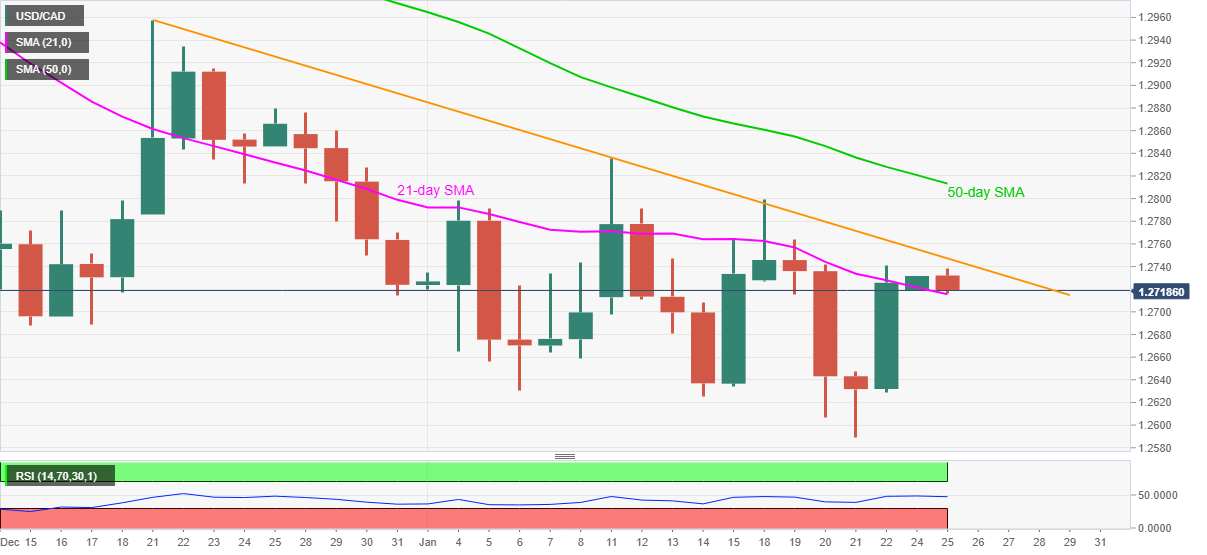

- USD/CAD fails to stretch Friday’s run-up below a five-week-old key resistance line.

- Normal RSI conditions, inability to stay beyond 1.2700 keeps bears hopeful.

- 50-day SMA adds to the upside filters, monthly low lures bears.

USD/CAD takes offers around 1.2718 in a fresh downside during the early Asian session on Monday. In doing so, the loonie pair trims Friday’s gains as sellers attack 21-day SMA.

Considering the pair’s repeated failures to stay strong beyond the 1.2700, coupled with the normal RSI conditions, USD/CAD sellers are likely to return.

However, a clear downside break of 21-day SMA, currently around 1.2715, needs validation from the 1.2700 threshold to recall the USD/CAD bears.

Following that, 1.2630 can offer an intermediate halt during the fall to the multi-month low marked the last week around 1.2590.

Alternatively, a downward sloping trend line from December 21, at 1.2747 now, guards the quote’s immediate upside, a break of which will enable the USD/CAD buyers to attack the 50-day SMA level of 1.2813.

Also acting as the upside barriers is the monthly high of 1.2835 and the late-December peak surrounding 1.2960.

USD/CAD daily chart

Trend: Pullback expected