- USD/CAD drops for the fourth day to refresh two-week low.

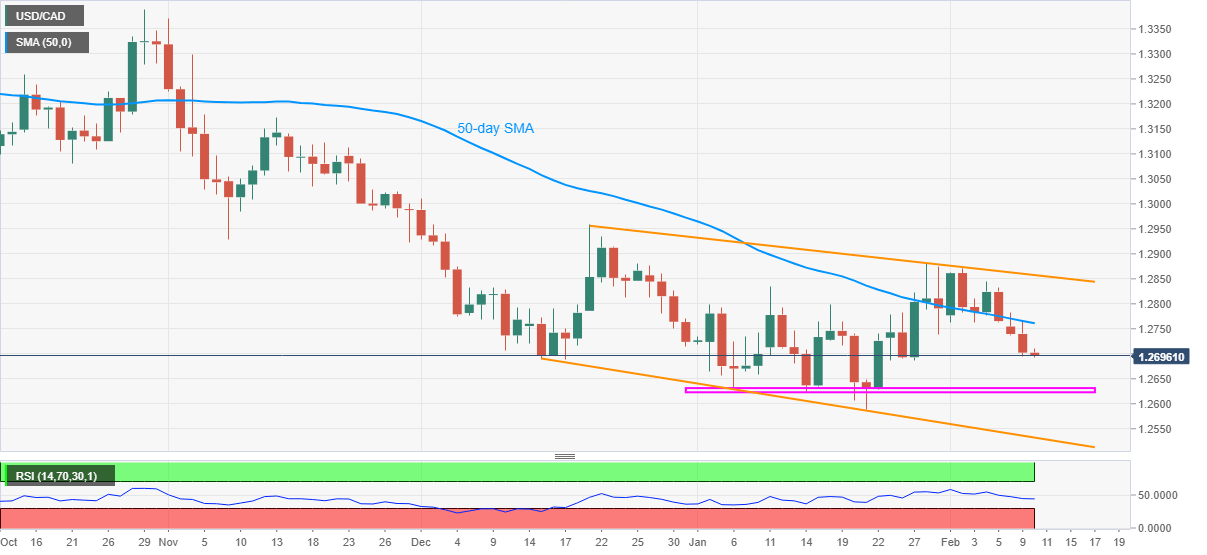

- Normal RSI, sustained trading below 50-day SMA and a short-term falling trend line favor bears.

USD/CAD stands on the slippery grounds as sellers attack 1.2700, currently down 0.06% intraday near 1.2695, during early Wednesday. The loonie pair remains on the back foot for the fourth day in a raw while extending its downside break of 50-day SMA.

Given the absence of oversold RSI conditions, coupled with the quote’s weakness below the key SMA, not to forget a falling trend line from December 21, USD/CAD bears are likely to keep the reins.

In doing so, multiple supports marked during the last five weeks, around 1.2630-25, seem to challenge the sellers targeting the sub-1.2600 area. However, January’s low of 1.2589 and a descending trend line from December 15, at 1.2532 now, should limit the pair’s downside afterward.

Meanwhile, a 50-day SMA level of 1.2762 guards the quote’s immediate upside ahead of the nearby resistance line close to 1.2860.

Following an upside break of 1.2860, January high and the late December top, respectively around 1.2880 and 1.2960, can test the USD/CAD buyers.

USD/CAD daily chart

Trend: Further weakness expected