- USD/CAD edged lower on Monday and eroded a part of the previous session’s strong positive to two-week tops.

- Bullish oil prices underpinned the loonie and exerted some pressure; renewed USD buying helped limit losses.

- The set-up seems tilted in favour of bullish traders and supports prospects for the emergence of some dip-buying.

The USD/CAD pair witnessed some selling on the first day of a new trading week and eroded a part of Friday’s strong positive move to two-week tops, around the 1.2745-50 supply zone. The pair was last seen trading near the lower end of its daily trading range, around the 1.2675-70 region.

A modest uptick in crude oil prices, now up around 1% for the day, underpinned the commodity-linked loonie and exerted some downward pressure. However, the emergence of some fresh US dollar buying interest extended some support and helped limit any deeper losses for the USD/CAD pair.

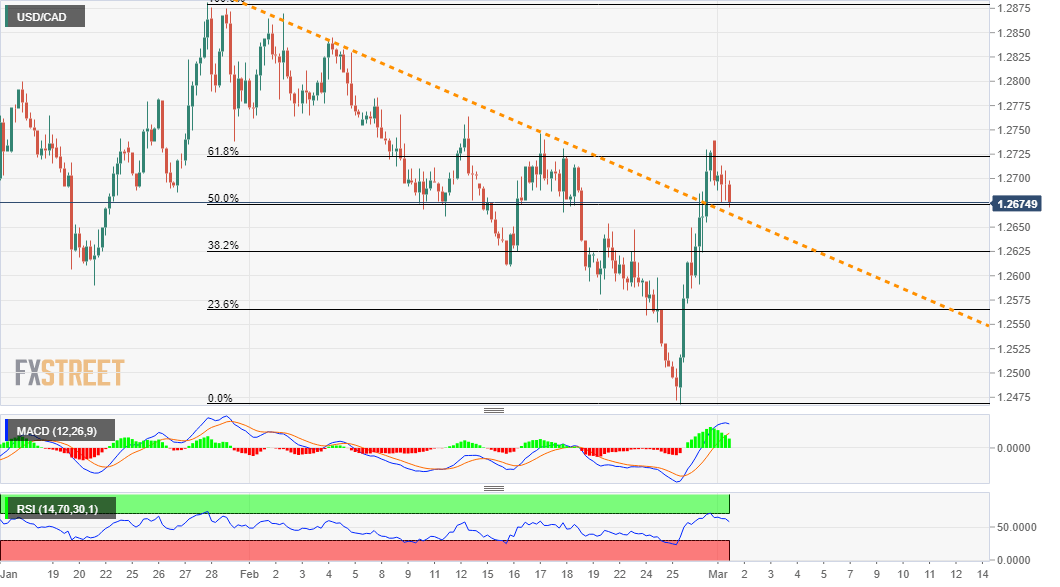

From a technical perspective, last week’s strong rebound from multi-year tops struggled to find acceptance above the 61.8% Fibonacci level of the 1.2882-1.2468 downfall. The subsequent pullback has now dragged the USD/CAD pair back to a short-term descending trend-line resistance breakpoint.

The mentioned resistance-turned support coincides with the 50% Fibo. level and should now act as a pivotal point for short-term traders. Given that oscillators on the daily chart have recovered from the bearish territory, the pullback could still be seen as a buying opportunity.

That said, a convincing break below mid-1.2600s will negate the positive outlook and turn the USD/CAD pair vulnerable to resume its prior/well-established downtrend. The pair might then accelerate the fall towards 38.2% Fibo. level, around the 1.2625 region en-route the 1.2600 mark.

On the flip side, the 1.2700 round-figure mark now seems to act as immediate resistance. This is followed by the 61.8% Fibo. and the 1.2745-50 hurdle. A sustained strength beyond will be seen as a fresh trigger for bullish traders and pave the way for further near-term gains.

The USD/CAD pair might then aim to surpass the 1.2800 round-figure mark and head towards the next major resistance near the 1.2865-85 region tested in January.

USD/CAD 4-hourly chart

Technical levels to watch