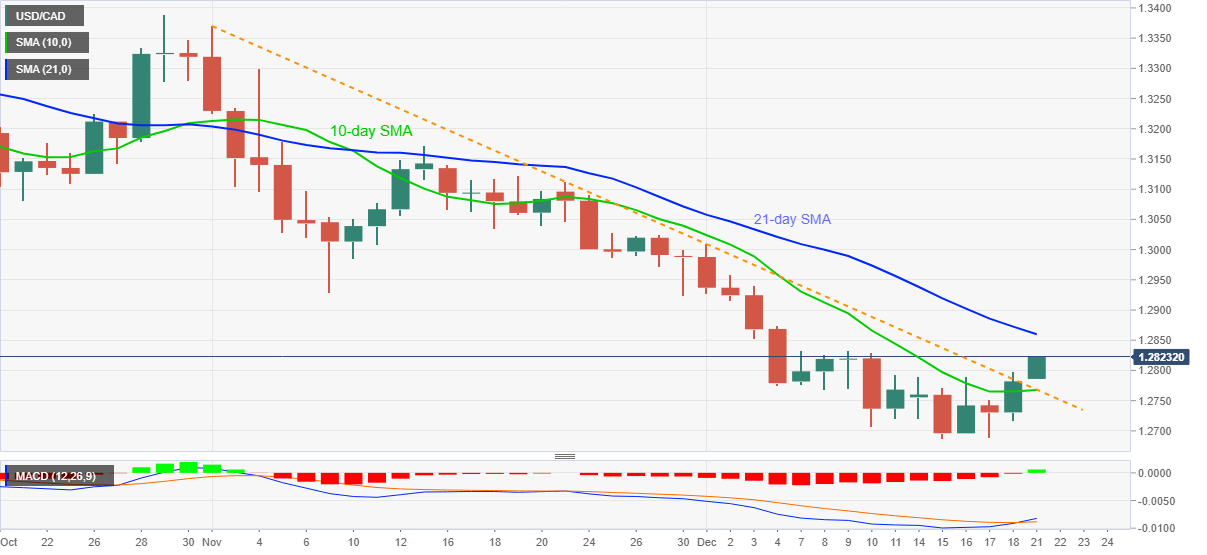

- USD/CAD battles intraday high while keeping upside break of 10-day SMA, seven-week-old falling trend line.

- 21-day SMA, early November lows on the bull’s radar.

USD/CAD rises to 1.2822, up 0.32% intraday, during Monday’s Asian session. The pair keeps upside break of a short-term key resistance line, now support, as well as 10-day SMA. Also favoring the bulls could be the MACD signals that turn positive for the first time after November 23.

As a result, USD/CAD prices are well directed towards a 21-day SMA level of 1.2860. Though, any further upside will be capped by November 09 low near 1.2930.

Also acting as the key resistance is the 1.3000 round-figure and the monthly top near 1.3010.

On the contrary, a downside break below 10-day SMA and previous resistance line confluence around 1.2765 will recall the sellers targeting the multi-month low of 1.2688. In doing so, the 1.2700 round-figure may add filters to the anticipated south-run.

It should, however, be noted that an extended downtrend past-1.2688 will not refrain from challenging the April 2018 low near 1.2530.

USD/CAD daily chart

Trend: Further recovery expected