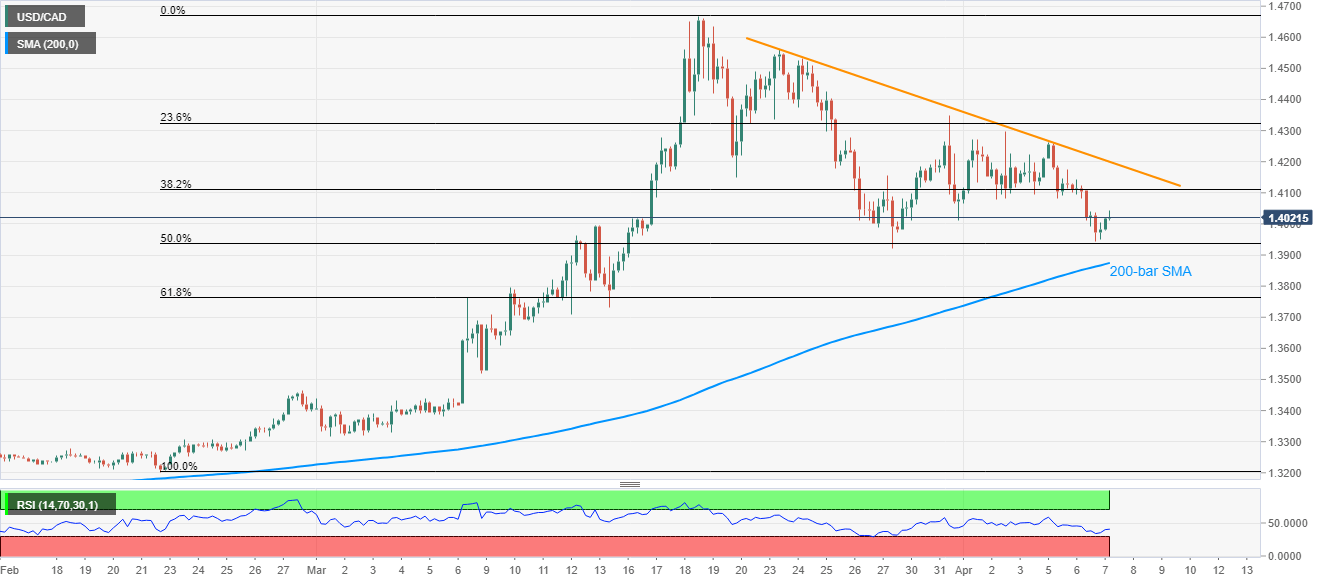

- USD/CAD recovers from an eight-day low, a fortnight-old falling trend line in focus.

- 200-bar SMA adds to the support.

- Canada’s Deputy Foreign Minister recently tested positive for the coronavirus.

USD/CAD remains mildly positive, up 0.23%, as taking the bids near 1.4030 during the Asian session on Wednesday. With that, the Loonie pair bounces off 50% Fibonacci retracement of its run-up from late-February to March 19, 2020.

Also favoring the pair’s recent recovery could be the news that the Canadian Deputy Minister Marta Morgan has tested positive for the coronavirus (COVID-19).

While 38.2% Fibonacci retracement level near 1.4110 is likely an immediate target for the buyers, a downward sloping trend line from march 23, currently at 1.4200, seems to add to the resistance.

On the contrary, 1.4000 can act as the nearby support for the pair before it can revisit 50.0% Fibonacci retracement level of 1.3935.

During the quote’s further declines below 1.3935, which are less likely considering the RSI conditions, 200-bar SMA figures of 1.3875 and 61.8% of Fibonacci retracement around 1.3760 will be the key.

USD/CAD four-hour chart

Trend: Pullback expected