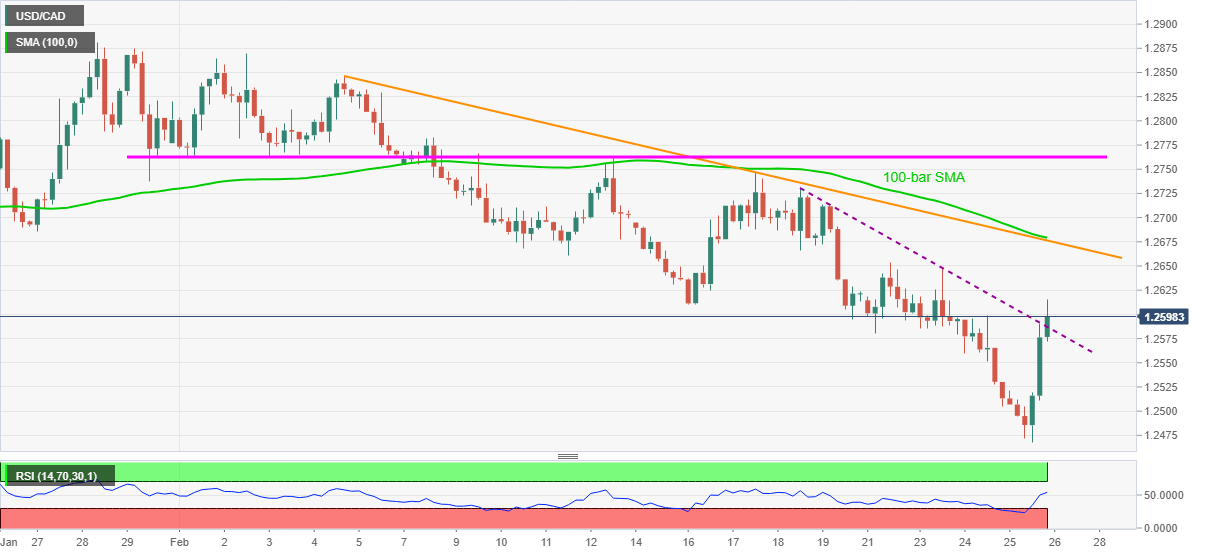

- USD/CAD bulls catch a breather after crossing one-week-old resistance, now support.

- Strong RSI suggests further rise but a confluence of 100-bar SMA, 16-day-old descending trend line probes the buyers.

- Bears can keep eyes on 2018 lows on the break of 1.2450.

USD/CAD retraces the previous day’s heavy recovery, the strongest in a month, while battling the 1.2600 threshold during Friday’s Asian session.

The quote dropped to the fresh low since 2018 before bouncing off 1.2468 on Thursday. In doing so, the loonie pair broke an immediate resistance line, now support, amid oversold RSI.

Given the currently strong RSI conditions, the latest recovery is likely to extend unless the quote holds the trend line breakout. However, a convergence of 100-bar SMA and a downward sloping trend line from February 04, currently around 1.2680, will be the key to watch.

In a case where the quote rallies past-1.2680, multiple levels around 1.2760-65 will lure the USD/CAD buyers.

On the contrary, a downside break of the previous resistance line, at 1.2585 now, should drag the quote back towards the 1.2500 threshold ahead of highlighting the latest low of 1.2468 for the USD/CAD bears.

Though, any further weakness will be challenged by the mid-February 2018 bottom surrounding 1.2450, a break of which may not hesitate to attack the 2018 low of 1.2248.

USD/CAD four-hour chart

Trend: Further recovery expected