- USD/CAD failed to build on the early attempted recovery move from multi-month lows.

- The set-up still favours bearish traders, albeit oversold conditions warrant some caution.

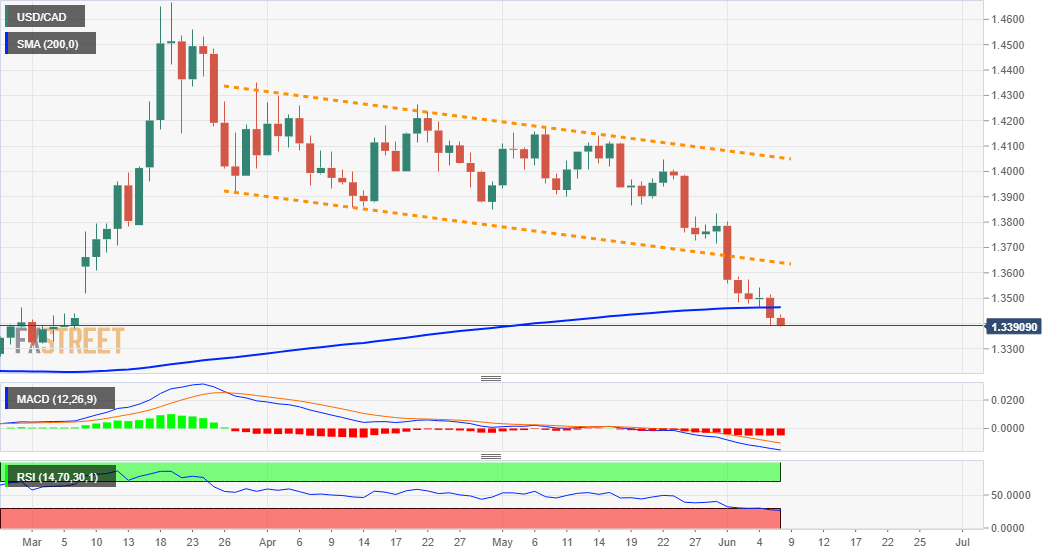

The USD/CAD pair struggled to capitalize on its attempted intraday recovery move and was last seen trading in the neutral territory, around the 1.3400 round-figure mark. The pair’s inability to register any meaningful recovery comes on the back of Friday’s break below the very important 200-day SMA and supports prospects for a further decline.

However, technical indicators on the daily chart are flashing slightly oversold conditions and seemed to be the only factor holding investors from placing fresh bearish bets. Hence, it will be prudent to wait for a bearish acceptance below the 1.3400 mark before traders start positioning for an extension of the pair’s three-week-old bearish trajectory.

The pair might then accelerate the fall further towards the next major support near the 1.3325 region before bears eventually aim to challenge the 1.3300 round-figure mark.

On the flip side, any meaningful move beyond the daily swing high, around the 1.3435 region, is likely to confront stiff resistance and remain capped near the 1.3465 region (200-DMA). That said, a convincing breakthrough might prompt some short-covering move and lift the pair further beyond the key 1.3500 psychological mark, towards testing the 1.3565-70 region.

USD/CAD daily chart

Technical levels to watch