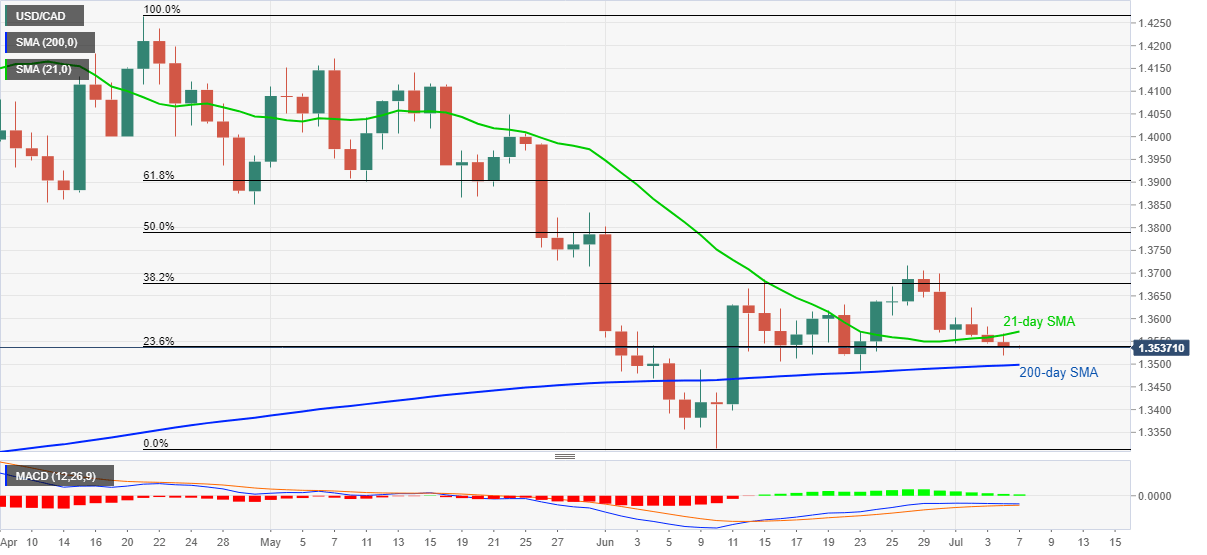

- USD/CAD seesaws near 23.6% Fibonacci retracement of April-June downside.

- The sustained break of 21-day SMA, lower high formation since last four days keep sellers hopeful.

- 200-day SMA will take support from MACD conditions to challenge the bears.

USD/CAD takes rounds to 1.3540/35 amid the initial Asian session on Tuesday. The pair carried Friday’s closing under 21-day SMA on Monday. This pushes the quote to portray a four-day losing streak by the press time.

As a result, the sellers are targeting a 200-day SMA level around 1.3500 as immediate support. However, the pair’s further downside becomes less anticipated amid bullish MACD.

Should the bears ignore MACD while keeping the helm below 1.3500, 1.3440/35 might offer an intermediate halt during the quote’s fall towards June month’s bottom near 1.3315.

On the contrary, an upside clearance of 21-day SMA, at 1.3571 now, will trigger a fresh recovery move targeting the June 26 top close to 1.3715. However, 1.3630 can act as an intermediate halt during the rise.

USD/CAD daily chart

Trend: Further weakness expected