- USD/CAD rises as the risk sentiment deteriorates amid coronavirus spread.

- Weaker oil prices support the bullish momentum in the USD/CAD.

- Central bank divergence may also provide room for further gains.

The USD/CAD price analysis suggests further gains as the fundamental and technical pictures indicate an uptrend.

The USD/CAD soared to fresh daily highs near 1.2565 on Monday. The recent upsurge stemmed from the rise in coronavirus infection in Japan and downbeat Chinese important data.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The USD/CAD is near 1.2560 at writing, with a daily gain of 0.38%.

Earlier in the day, during the Asian session, the Chinese retail sales data came up with a big miss. The figures came at 8.5% y/y against the expected 11.5% and the previous 12.1%. Moreover, the industrial production figures also fell to 6.4% y/y in July, far below the market expectations and previous reading of 8.3%. The dismal data weighed on commodities like Canadian Dollar, Australian Dollar, and the New Zealand Dollar.

Moreover, the crude oil also started the week negatively on Monday and lost around $2 until now. The commodity-linked Loonie came under pressure because of lowered oil prices. The downtrend is likely to continue.

The Bank of Canada maintains a dovish tone as the economic progress is not up to the mark. On the other end, Fed’s stance is coming out of the clouds, and Fed can outline its plan to taper the asset purchase during the Jackson Hole symposium in the last week of August. Moreover, meaningful hints can be found in the FOMC meeting minutes to be released this week.

Coronavirus fears worldwide

The Covid concerns have started rising again. The UK, Japan and China saw a surge in the new coronavirus cases. This factor has dampened the risk sentiment, lending more room to the safe-haven Greenback.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

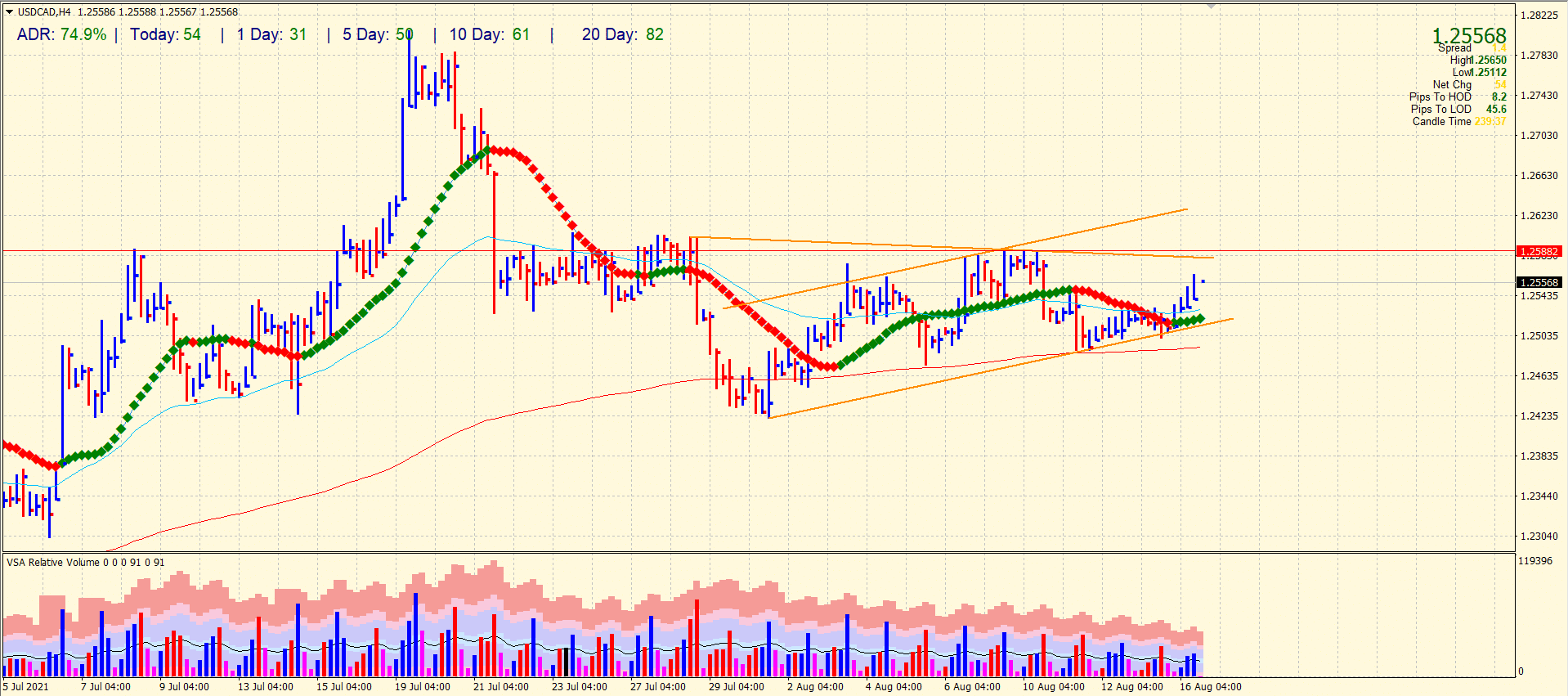

USD/CAD price technical analysis: 200 SMA to support bulls

The USD/CAD pair is moving within the bullish trend channel. The pair is well above the 20-period and 50-period SMAs on the 4-hour chart. The downside seems supported by the 200-period SMA and psychological mark of 1.2500 as well. On the upside, the immediate resistance is provided by the descending trendline at 1.2580 followed by the horizontal level of 1.2590 area.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.