- USD/CAD is facing a continuous drop for the last two sessions.

- Higher Crude oil prices provide gains to the Canadian Dollar, followed by the Canadian CPI.

- Strong fallback in US Dollar from the weekly high as Fed kept its benchmark interest rate unchanged.

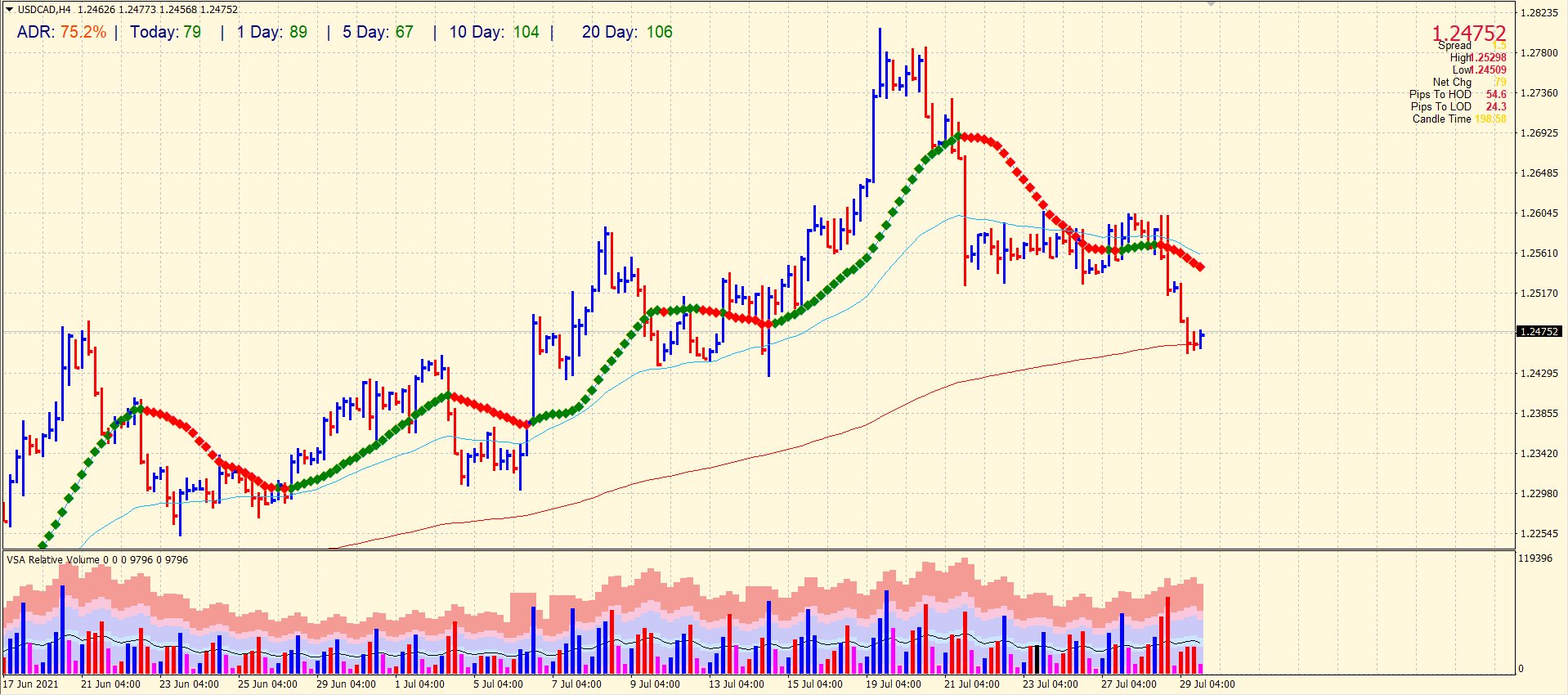

In the early European session, USD/CAD resumed its previous session’s losses. On Thursday, the USD/CAD price goes against the market’s expectations and breaches the 1.2500 psychological level. The USD/CAD pair is trading at 1.248 noted in the recent hours. It is considered as a decline of 0.32% today.

–Are you interested to learn more about automated trading? Check our detailed guide-

Furthermore, Canadian CPI data for June reported at 3.1% against the 10-year high of 3.6% in May while the market forecast was at 3.2%. It helped the Canadian Dollar against the Greenback.

The prices of crude oil increased that lifted the optimism of the financial markets. Also, it assisted in improving the market sentiments that allow the Loonie to regain its value from lower levels. One of the major exports of Canada, crude oil, recently traded at almost $72.62 with an increase in gains by 0.32%.

The US Dollar Index tracks the Greenback performance against its six major competitors. Still, the US Dollar Index (DXY) maintains its position in lower levels at 91.15. Fed used a diplomatic way to cap any upside momentum in the Greenback. Fed tried to maintain its benchmark interest rate at the record-low level of zero. It is all because of growing issues over the exponentially rising inflation and Delta variant exposure.

The economic proceedings peruse the traders to look towards the US Price Consumption Expenditure Index (PCE), Gross domestic product (GDP), and Initial Jobless claims data. It will provide a driving force for traders to find a fresh trading impetus.

–Are you interested to learn more about forex signals? Check our detailed guide-

USD/CAD price technical analysis: Bears to crack 200-SMA

The USD/CAD maintains a bearish outlook amid today’s fall under 1.2470, with today’s daily change of -0.40%. USD/CAD still remains supported by the 200-period SMA on the 4-hour chart. Also, the 50-period and 100-period are pointing in a downward direction predicting more losses.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.